Mutual help is way forward, says Tang

By Wu Jiao (China Daily)Updated: 2007-06-22 09:19

Q:

The Hong Kong economy has been growing at an average of 7.6 percent annually for

the past three years. But we have also noticed that the annual growth rate has

dropped since 2004. Is the growth lacking impetus?

Q:

The Hong Kong economy has been growing at an average of 7.6 percent annually for

the past three years. But we have also noticed that the annual growth rate has

dropped since 2004. Is the growth lacking impetus?

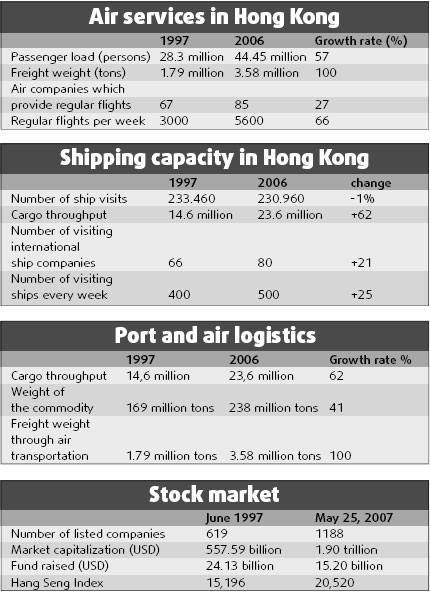

A: As a developed economic system, Hong Kong's economic growth pattern is different from that of the motherland, which has seen rocketing GDP growth for a decade. We have witnessed an average annual growth of 4 percent during the past 10 years. But for developed Western countries, the average GDP growth for the same period has only been 1 to 2 percent every year. A growth rate of 2 percent is fairly good for a developed economy. We have forecast the growth rate for 2007 and 2008 to be around 4.5 to 5.5 percent, which is only half of the 8.6 percent achieved in 2004.

Speedy economic growth has brought us inflation. I don't welcome long-term speedy economic growth. Inflation rate is about 1 percent at present, which is pretty normal. If we can keep economic growth at 4 to 5 percent while the inflation rate at below 2 percent in the long-term, that would be a healthy economy. Different from the mainland where the central government can control inflation on some basic necessities, food prices in Hong Kong fluctuate according to market forces.

Q: What's Hong Kong's contribution to the mainland in the country's strategy of "encouraging investment" and "helping domestic enterprises enter the world market"?

A: Hong Kong has played a very successful role in helping to boost investment on the mainland. About 40 percent of foreign investment injected into the mainland up to now has been through the financial platform of Hong Kong. And I believe Hong Kong will play a bigger role in facilitating mainland companies enter the world market. We are familiar with the mainland, and we have zero obstacles in communication. The most important fact is that we are part of the same country. We have to reflect all the time what we can do for the country.

Q: What is the next new economic growth sector for Hong Kong?

A: The new growth sector will be the service industry, especially the financial services sector. The reform and opening up of the motherland has generated huge demand for quality financial professionals. To develop well in this sector will help Hong Kong to contribute further to the motherland's economy. Of course, Hong Kong will also benefit in the exchange. This is a win-win situation. For instance, the listing of mainland companies in Hong Kong helped accelerate the amount of the initial public offering. We will continue to provide our financial services. I suggest Hong Kong's financial market and the mainland's domestic market establish an interactive, collaborative and complementary relationship. The two markets are developing at different levels. There is huge room to be complementary. Also, as part of the same country, Hong Kong has the obligation to help the mainland. We could also offer expert advice to our mainland counterparts on global markets.

Q: What were the major challenges to Hong Kong's economy during the past 10 years?

A: The biggest challenge since its return to the motherland was coping with the Asian financial crisis. We managed to maintain the stability of our currency by linking it to the US dollar. But the value of our fixed assets dipped sharply. For instance, the value of the real estate market dropped about 60 percent in a year. The second challenge was huge deflation pressure. Our GDP deflator dropped 24 percent, and reached its lowest level since 2000. Our countermeasure was to rely on the determination of the people of Hong Kong. I have been consulting frequently with the people of Hong Kong since being appointed secretary of finance. Help from the central government has also become a key factor. CEPA, the individual visit scheme, and free trade with Hong Kong, has become a win-win situation. We made a five-year financial recovery plan in 2003. We succeeded in recovering our financial deficit within two years.

Q: What's your opinion on the central government's move to open RMB business to Hong Kong?

A: The opening of RMB business is something the mainland will do in the future. And Hong Kong provides the ideal place for the experiment.

Q: What are the underlying problems facing Hong Kong's economic structure?

A: HK boasts a free and open market economy, which encourages money making by innovation and entrepreneurship. We boast a low corporate tax rate of 17.5 percent. But this could lead to a widening gap between the rich and the poor. We have established a safety network to ensure basic life necessities and housing for the poor. We will gradually perfect the system.

Also, demands by the people are increasingly growing. While it was a British colony they did not expect much. But now as the master of the region, people hold higher expectations of the government. We will work toward a harmonious society.

|

||

|

||

|

|