|

CHINA> Taiwan, HK, Macao

|

|

Lehman collapse causes Hong Kong hangover

(China Daily)

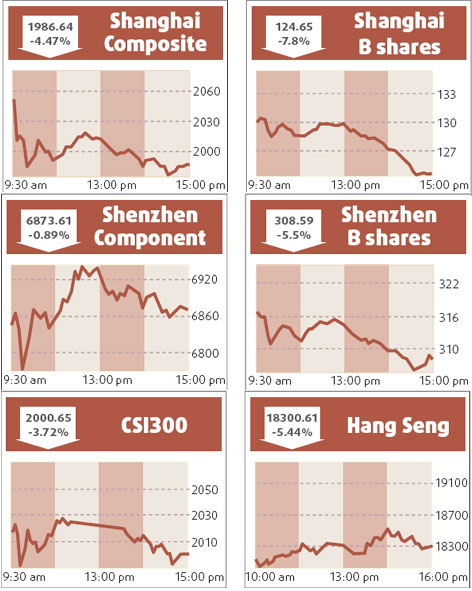

Updated: 2008-09-17 07:50  Hong Kong's shares tumbled 5.4 percent to a near two-year low yesterday after Lehman Brothers sought bankruptcy protection and fears about the US financial system knocked equity markets down across the world. Financial plays tumbled after Lehman failed to find a rescuer, insurer AIG struggled for survival and Merrill Lynch was snapped up by Bank of America, all of which unleashed a wave of global stock selling on Monday, when Hong Kong markets were closed for a holiday. Analysts said fears over the US financial system would carry on plaguing the market and drag it yet lower as long as investors remain unsure whether US markets have hit bottom. "There's a lot of issues investors need to deal with over the next few weeks - first of all, what's going to happen to AIG?" said Alex Tang, research director at Core Pacific-Yamaichi International. AIG, thrown a $20 billion lifeline by New York state, came under renewed pressure as ratings agencies downgraded its debt. "We are not expecting a major comeback. But major players and fund managers might start accumulating shares on any major dips because the valuations are good," Tang said. Tang added that investors are keenly waiting for more decisions from the US Federal Reserve, which held a one day interest rate meeting on yesterday. The benchmark Hang Seng Index ended down 1,052.29 points at 18,300.61, dragged down by steep losses in finance, energy, and telecom plays. It was the largest single-day percentage drop since January. Shares in Chinese insurer PICC Property and Casualty - 9.9 percent owned by AIG - plummeted 20.2 percent to a near-two year low. Heavyweight China Mobile fell nearly 6.1 percent. The Chinese Enterprises Index of mainland companies listed in Hong Kong ended down 7.4 percent at 9,236.58, less than half of last year's high of 20,609.10, and its lowest level in 18 months. Mainboard turnover climbed to roughly HK$88.4 billion, compared to Friday's HK$57.8 billion. Joseph Yam, chief executive of the Hong Kong Monetary Authority (HKMA), said Lehman Brothers' bankruptcy filing will have a negative impact on Hong Kong markets but the city's central bank will provide liquidity if needed. "Although the US stock market had a sharp fall on Monday, (there was) no panic selling," Yam said. Agencies  (China Daily 09/17/2008 page15) |

主站蜘蛛池模板: 明溪县| 阜新市| 平陆县| 肥东县| 东城区| 安庆市| 易门县| 横峰县| 桃江县| 那坡县| 通辽市| 巴楚县| 台湾省| 蓝田县| 长汀县| 银川市| 滁州市| 资溪县| 汉寿县| 桓台县| 渝中区| 鄂托克前旗| 平乐县| 紫阳县| 江永县| 西平县| 宁陕县| 全南县| 弥勒县| 广德县| 监利县| 太保市| 渭南市| 沁源县| 汉沽区| 寿光市| 宁晋县| 定日县| 高雄县| 壤塘县| 华阴市| 安庆市| 台南市| 察隅县| 扬州市| 娱乐| 盐山县| 武汉市| 丹寨县| 葵青区| 邓州市| 修文县| 武邑县| 康平县| 古蔺县| 安溪县| 和静县| 乐平市| 阳曲县| 寻乌县| 大埔区| 涞水县| 安福县| 临夏县| 九江市| 兴安县| 大城县| 肃宁县| 平舆县| 绵竹市| 大新县| 绥芬河市| 长治市| 静宁县| 遂宁市| 柳河县| 叶城县| 呼玛县| 兴安县| 阿拉尔市| 锡林浩特市| 长垣县|