|

CHINA> National

|

|

China's US treasury debt holdings up

By Xin Zhiming (China Daily)

Updated: 2009-02-19 07:53

China's treasury debt holdings in the US grew by $14.3 billion in December amidst speculation that it was seeking other options to deploy its nearly $1.95 trillion in foreign exchange reserves.

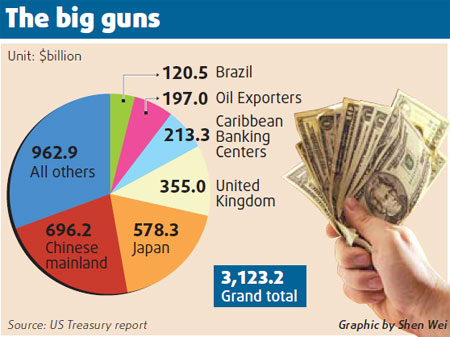

The nation's holdings of the treasuries totaled $696.2 billion in December, up from $681.9 billion in November 2008, the US Treasury international capital flow report released yesterday showed.

China has accelerated its holdings of treasury debt since August 2008, when holdings grew by $23.7 billion month-on-month. By September, it had replaced Japan as the primary holder of these debt instruments. Analysts said since the treasuries are relatively stable in value compared to other financial products, China has apparently aimed to play safe by buying up these US bonds. However, now that China's holdings of treasuries account for one-third of its foreign exchange reserves, some warned that "putting all eggs in one basket" is risky. "China needs to diversify its foreign exchange reserves basket," said Zhang Ming, economist with the Institute of Finance and Banking at the Chinese Academy of Social Sciences. "Its holdings of these treasuries face the danger of a price drop as the US is expected to issue more bonds to stimulate its economy," he told China Daily. With US interest rates at near-zero levels, the dollar's value may slide, and its recent strong rally may not sustain, economists said. The sliding dollar will push down treasury debt prices, economists said. "As these treasuries are much sought after by international investors, it is time China took advantage of the timing to cut its holdings," Zhang said. China should use its abundant foreign exchange reserves to buy commodities and energy products to support its economic growth, said Guan Qingyou, a researcher with Tsinghua University. Premier Wen Jiabao has said that the country is studying ways to use its foreign exchange reserves to buy equipment and technologies that are key to its economic development. Despite uncertainties about the prices of US treasuries, international investors remain invested in the US market. The report has shown that net capital inflows into the US rose to $74 billion in December from $61.3 billion in the previous month. Foreign holdings of dollar-denominated short-term US securities, including treasury bills, increased $2.1 billion in December. Net foreign purchases of long-term securities reached $22.4 billion in December compared with a net selling of securities worth $37.6 billion in November, according to the report. |

|||||

主站蜘蛛池模板: 英吉沙县| 内乡县| 庆阳市| 阳原县| 韶关市| 潞西市| 通州区| 东乌珠穆沁旗| 满城县| 平罗县| 乌海市| 武宣县| 霍州市| 涟源市| 虞城县| 杨浦区| 株洲市| 闽侯县| 阳江市| 通山县| 太仓市| 瑞金市| 青铜峡市| 合水县| 峡江县| 利津县| 宜宾市| 康平县| 桐乡市| 重庆市| 东丽区| 二连浩特市| 长宁县| 遵义县| 华亭县| 沙湾县| 胶州市| 涞水县| 孟连| 澄江县| 沙洋县| 怀来县| 从化市| 枣强县| 凯里市| 灵川县| 黄大仙区| 汉寿县| 天峨县| 清河县| 康乐县| 南木林县| 仁布县| 句容市| 达孜县| 东源县| 台南市| 东明县| 灵川县| 镇坪县| 合水县| 柘城县| 平陆县| 城市| 永川市| 乐都县| 土默特右旗| 炉霍县| 南郑县| 呼伦贝尔市| 日土县| 和林格尔县| 商丘市| 沁源县| 巧家县| 海伦市| 耿马| 闽侯县| 芮城县| 南京市| 双鸭山市| 扎鲁特旗|