|

CHINA> National

|

|

China cautioned to lend less to IMF

By You Nuo and Fu Jing (China Daily)

Updated: 2009-03-17 07:43 China should not give huge loans to the International Monetary Fund (IMF), which is planning to offer a helping hand to some European countries struggling due to the economic crisis, a top economist warned.

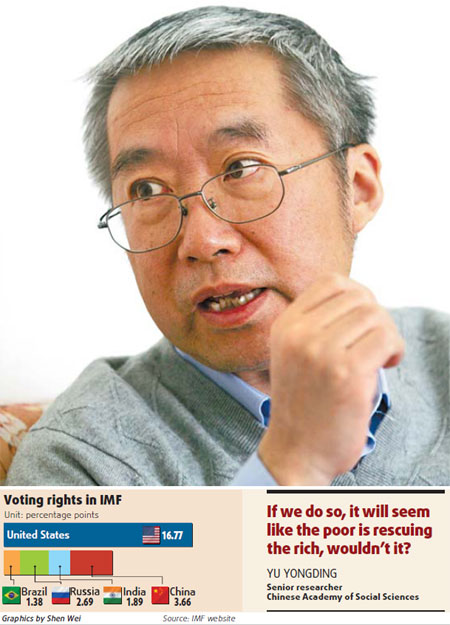

But he insisted that China should help the African countries suffering from credit crunch. Yu's point of view comes even as there is hectic lobbying for China and other countries to lend more to double the IMF kitty to $500 billion as a precautionary measure in case the crisis worsens and more countries need to access money. Japan has already contributed an extra $100 billion. "They (developed countries and pressure groups) have already targeted our wallets but we have many reasons to object," said Yu, a formal central bank advisor. First, China is ranked 100 out of 192 UN members in terms of per-capita GDP despite the fact that it is the third biggest economy in the world after the US and Japan. Many of the troubled countries that IMF wants to rescue have a per capita income that is much higher than the average Chinese. They have also enjoyed at least one decade of economic prosperity and their living standards are still far higher than China's. "If we do so, it will seem like the poor is rescuing the rich, wouldn't it?" said Yu. Second, Yu said the countries on the IMF rescue list, especially some from Europe, have an anti-China mentality. "Their pitches are even higher than some Western countries sometimes when they protest against China," said Yu. "We have no reason to help them." Yu said the Chinese public would also not agree to such measures. He added that China's friends in the developing world have cautioned against giving loans to the IMF. "Even if you do decide to do so, the sum should not be big," Yu quoted them as saying. "Even if China decides to inject a large sum of money, it is pointless to increase its weight in the international financial organization," said Yu. This is because the US still holds veto rights in the decision-making process of the IMF. "The most substantial step, if any, should be the removal of the US' right to veto," said Yu. "But it's a difficult task." Currently, developed economies dominate international institutions. For example, the voting rights of the BRIC countries, Brazil, Russia, India and China, in the IMF are 9.62 percent of the total, together accounting for about half of the voting rights that the US holds. At the recent summit of the G20 finance ministers and central bank governors, the next review of IMF quotas is likely to be completed by January 2011. The meeting also agreed to increase the representation of emerging countries in international financial organizations. Yu, however, said China's reputation in the international community would be enhanced if it does lend the huge amounts. It would also contribute to the stabilization of world economy, he said. "At the coming G20 summit, China's leadership should take a decision to do, or not to do," said Yu.

|

|||||

主站蜘蛛池模板: 柞水县| 乌海市| 曲沃县| 左云县| 镇坪县| 颍上县| 富民县| 山西省| 连云港市| 沅陵县| 镇安县| 谢通门县| 德钦县| 浠水县| 龙岩市| 竹山县| 海城市| 民县| 溧阳市| 林周县| 章丘市| 怀安县| 金堂县| 五原县| 茌平县| 江永县| 宝清县| 古田县| 孟州市| 许昌市| 洛隆县| 精河县| 麟游县| 秭归县| 邵阳市| 鄱阳县| 莱西市| 塔河县| 舟山市| 荃湾区| 理塘县| 阳高县| 广河县| 香河县| 建水县| 铁岭市| 利津县| 乃东县| 阿巴嘎旗| 遂平县| 连州市| 雅江县| 达日县| 福海县| 昌宁县| 娄底市| 明光市| 淳安县| 旬邑县| 金阳县| 即墨市| 建宁县| 德令哈市| 叶城县| 十堰市| 江源县| 游戏| 东宁县| 峨眉山市| 阿巴嘎旗| 托里县| 阳高县| 浮梁县| 辽阳市| 扶绥县| 高要市| 丰都县| 南投县| 永顺县| 沈丘县| 县级市| 江西省|