|

CHINA> National

|

|

Coke bid for juice maker turns sour

By Diao Ying and Ding Qingfen (China Daily)

Updated: 2009-03-19 07:22 The government rejected Coca-Cola's plan to acquire beverage maker China Huiyuan Juice Group Ltd for $2.4 billion on Wednesday, citing the country's anti-monopoly law. The acquisition by Coca-Cola, announced last September, would have been the largest ever buyout of a Chinese company by a foreign rival.

"If the acquisition went into effect, Coca-Cola was very likely to reach a dominant position in the domestic market and consumers may have had to accept a higher price fixed by the company as they would not have much choice," the statement said. The MOC launched an anti-trust investigation on Nov 11 to determine whether the acquisition would harm other rivals, consumer rights or technological innovation.

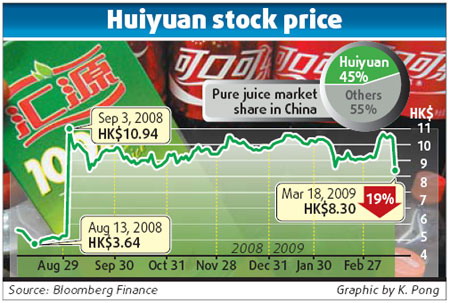

The bid was the first major deal to test the Anti-Monopoly Law, which took effect on Aug 1 last year. If passed, the deal would have been Coca-Cola's largest overseas acquisition and the company would have been able to expand its dominant position in the carbonated drinks market to the juice market. The ministry said that Coca-Cola and Huiyuan are major brands in the juice market, and therefore, the combination would have restricted competition in the industry and made it more difficult for other players to enter the sector. The ministry said the deal would also have squeezed development space for other small- and medium-sized enterprises, and is not good for the development of the country's juice industry. Huiyuan said yesterday that it respects the decision made by the ministry, and production would continue as normal. The company's share dived 19.24 percent to HK$8.30 yesterday before trading was suspended shortly after the market opened in the morning.

Muhtar Kent, president and chief executive officer of Coca-Cola, said: "We are disappointed, but we also respect the MOC decision." He said the company had put a tremendous effort into providing all the relevant materials to the MOC to ensure that they had all the information available and understood the transaction. "We were looking forward to working with the excellent Huiyuan team to stimulate new growth for the Huiyuan brand." He said the company will now focus all of its energies and expertise on growing existing brands and continuing to innovate with new brands, including in the juice segment. Huang Wei, beverage analyst at China Jianyin Investment Securities, said: "The ministry's decision is not surprising. But it's not good for Huiyuan, whose market share will probably shrink as international players such as Coca-Cola invest more in the juice market." Coca-Cola's offer to buy the Hong-Kong listed company was seen as a major strategic move to tap China's fast growing juice market. While the world's largest soft drink manufacturer dominates the carbonate market in China, its share in the juice market is relatively small. On the other hand, Huiyuan is the largest juice beverage maker in China, with over 45 percent of the pure juice market in the country. It also controls more than a tenth of the Chinese fruit and vegetable juice market that grew 15 percent last year to $2 billion. Coca-Cola has a 9.7 percent market share and dominates in diluted juices. China is Coca-Cola's fourth-largest market and a key battleground with rival PepsiCo Inc. Huiyuan's founders and major shareholders had endorsed the sale as a way for the company to improve product development and marketing. An MOC official said Coca-Cola had tried to address the negative effects on competition after it sought government approval for the deal in November, but its efforts did not meet the requirements of regulations. "It is only an isolated case, and it does not suggest any change in China's policy on foreign investors," the official said. The MOC said it has investigated 29 proposed acquisitions under the anti-monopoly law since August and approved 24. Xinhua, Reuters and AP contributed to the story |

|||||

主站蜘蛛池模板: 桦川县| 彭水| 邳州市| 股票| 民县| 达日县| 大丰市| 蕲春县| 永城市| 香港| 江津市| 胶南市| 双柏县| 芜湖县| 霍林郭勒市| 兴业县| 丰原市| 阿拉善右旗| 巴中市| 寿阳县| 珲春市| 上林县| 方城县| 古蔺县| 台前县| 大港区| 衡山县| 赞皇县| 上饶县| 太白县| 鲜城| 正镶白旗| 香格里拉县| 韶山市| 新巴尔虎右旗| 辽宁省| 和平县| 白水县| 温宿县| 昂仁县| 临泽县| 黄平县| 利津县| 靖州| 宁阳县| 桦川县| 平湖市| 开平市| 永德县| 酉阳| 册亨县| 临高县| 寿光市| 德令哈市| 麦盖提县| 大荔县| 湖北省| 浙江省| 大方县| 金塔县| 林州市| 镇安县| 宁波市| 内黄县| 毕节市| 陕西省| 乌兰浩特市| 台山市| 绵阳市| 贡山| 同心县| 奉贤区| 霍州市| 江安县| 吴川市| 新疆| 松江区| 南江县| 广平县| 灌南县| 雷州市| 阳信县|