Open up private market, Li says

Assessment of economy shows'impractical'barriers for SMEs

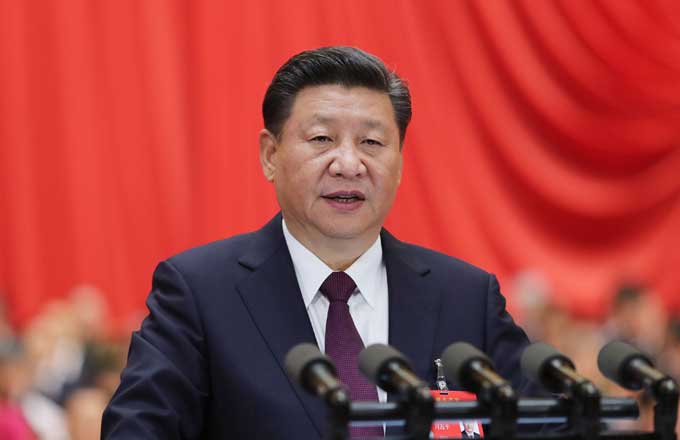

Premier Li Keqiang on Friday reiterated the need for greater efforts in removing obstacles that restrain private investors from entering previously monopolized sectors.

At an executive meeting of the State Council, China’s Cabinet, Li listened to the result of an assessment of the environment for private investors, which was conducted by the All-China Federation of Industry and Commerce.

The assessment came three years after the country renewed its guidelines to facilitate private investment in certain sectors and provide the private economy with more supporting policies.

However, while approving the positive results achieved by the guidelines since they were published in 2010, the independent survey found there were still many flaws in the implementation of the guidelines.

"There are many policy barriers set for private enterprises when entering the market and some of the guidelines are impractical or have very high thresholds," the survey stated.

"In addition, the guidelines lack an examination mechanism, and there are many regulations that are not adjusted according to the guidelines. They are hindering the effectiveness of the guidelines."

Li urged governments to make detailed and future modifications in the regulations that restrict private investment activities, thereby setting up practical market entry rules.

"We should introduce a number of projects that are in line with technical upgrade requirements to private capital as soon as possible, in areas such as finance, oil, electricity, railways, telecommunications, resource development and public utilities," Li said, adding these projects will have demonstrative effects.

In the first seven months of the year, privately funded fixed-asset investment nationwide amounted to 14.12 trillion yuan($2.3 trillion), growing 23.3 percent year-on-year. Private investment accounted for 63.7 percent of the total investment volume registered.

But private investors are still facing an arduous task in monopolized areas such as the financial sector.

In the city of Wenzhou, Zhejiang province, some businessmen have tried to launch privately owned banks in the past two to three years. Two plans have been handed in to the city government, but no feedback is yet available.

"We are keen to help more small and medium-sized enterprises with temporary financial problems by gathering money from successful large-sized enterprises and businessmen returned from overseas," said Jiang Yongzhong, head of Wenzhou Chamber of Commerce in Jinhua, a city in Zhejiang province and one of the initiators of the plan.

However, no detailed instructions were established to allow and guide private capital in the financial sector in the past two years and it still seems very difficult for private capital to progress.

"It is so encouraging to hear that the State Council is planning to lower the requirements and offer more chances for private capital to make investments in the market in the near future," said Jiang.

Jiang added that he hopes the dream of opening the first privately owned bank will come true soon.

In addition, certain private enterprises are pleading for equal opportunities with the large-sized State-owned companies over making investments in any field.

"It has been more difficult for small private enterprises than those larger companies to be allowed to make investments in government projects, which mostly offer stable returns," said Li Zhongjian, manager of Wenzhou-based Zhejiang Tung Fong Lighter Industrial Co, which makes lighters for overseas and domestic buyers.

Experts say promoting interest rate liberalization and allowing private capital to enter the financial system will boost the real economy eventually.

"Allowing private capital to enter the financial system with fewer restrictions and take part in more cooperation with banks to offer reasonable interest loans for SMEs (small and medium-sized enterprises) is probably a win-win method to help them and create a more diversified investment environment to allow private capital to flow," said Liu Shengjun, deputy director of the Lujiazui International Finance Research Center at the China Europe International Business School.

Contact the writers at weitian@chinadaily.com.cn and Yuran@chinadaily.com.cn

?Registration Number: 130349