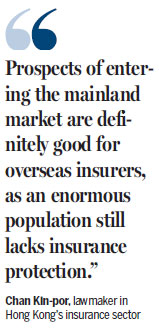

Insurers make a beeline for mainland market

'Protection gap'

According to official statistics, the Chinese mainland is one of the largest insurance markets in the world, with its current "protection gap" at an estimated $18 trillion and it may exceed $46 trillion by 2020.

In January, the regulatory commission also lowered the maximum shareholding in insurers to 33 percent from 51 percent, which means overseas insurers will have to find two partners instead of one before they can start operating.

"With the new regulations coming into effect, the number of players in the market will be reduced," said Eunice Tan, director of financial services ratings at S&P Global Ratings.

She noted that many Hong Kong-related insurance companies have already entered the mainland market but, globally, overseas companies have mixed views on the mainland thrust.

"Of course, the opportunities in China are very large, but Sino-foreign joint ventures only account for a small part of the insurance market, with premiums growing in single digits each year, which means foreign players in China don't find it very profitable," Tan said, adding that mainland customers prefer to buy local brands with which they are familiar, such as China Life.

That means, the market for joint ventures is not growing as fast as that for local companies, she said.

However, she said that from the mainland's point of view, joint ventures are good for the country as experienced overseas partners can bring their advanced risk management and asset management strategies in joint ventures with their mainland counterparts.

Deeper integration

Hong Kong's insurance sector has been calling for deeper integration with the mainland for a long time. The good news for the sector is that the Office of the Commissioner of Insurance in Hong Kong and the regulatory commission signed the Equivalence Assessment Framework Agreement on Solvency Regulatory Regime in Beijing in May to conduct equivalence assessment on the insurance solvency regulatory regimes of the mainland and Hong Kong.

The regulatory commission will introduce preferential policies on the Hong Kong insurance sector based on the equivalence assessment.

Under the Closer Economic Partnership Arrangement between Hong Kong and the mainland, Hong Kong insurance companies are allowed to enter the mainland market through strategic mergers with mainland companies, subject to a number of conditions.

Those include: the group holding total assets exceeding $5 billion; more than 30 years' establishment experience attributable to one of the Hong Kong companies in the group; and one of the Hong Kong enterprises having a representative office on the mainland for more than two years.

To date, several insurance pioneer companies have been licensed to do business on the mainland. Manulife Financial Corp in Toronto teamed up with Sinochem Finance 20 years ago to form Manulife-Sinochem Life Insurance; while in 2013 Hong Kong's Convoy was the first to obtain the mainland's National Insurance Agent License.

Three years later, Prudential partnered with CITIC to form CITIC-Prudential Life Insurance Co, strengthening its footprint across the country.

Earlier this year, He Xiaofeng, head of the regulatory commission's development and reform department, warned that the regulator needs to prevent the resurgence of overheating problems in the insurance sector.

"We're worried that once the market opens up, everyone will apply for a license. But cultivating talent cannot catch up with the speedy development. This kind of expansion is worthless," he said.

The regulatory commission is guided by three overriding principles in granting licenses.

Preference is given to institutions that operate in line with key national policies. They include the Belt and Road Initiative and free trade zones, and those with a regional balance will get due consideration, with favor given to companies supporting the development of the middle and western parts of the country.

Companies focusing on professional innovation and development will be issued with licenses that are in short supply, such as those for setting up captive insurance and reinsurance companies, as well as asset management businesses.