Corporate debt burden a systemic risk

"Extremely" high corporate debt ratios pose a systemic risk to the world's second-largest economy, one that will persist as long as bank debt dominates total financing, a senior government adviser said on Thursday.

Li Yang, deputy head of the Chinese Academy of Social Sciences, a government think tank, said China's total debt to GDP ratio is 168.9 percent, a "healthy" figure considering that the global average is 200 percent, and is 500 percent in some large economies.

"But debt among enterprises amounts to 105.4 percent of GDP, which is the highest compared with other countries such as the United States and Japan."

Li said the figure far exceeds the generally accepted safety ceiling of 80 percent.

"If the economy keeps slowing, the probability of default will increase more rapidly, given that the majority of the debts involve bank loans.

"The non-performing loan rise among lenders will threaten the financial system as well as the whole economy," he said.

Bank loans account for 60 to 70 percent of all financing, said Guo Shuqing, China's top securities regulator.

Although the nation's overall debt ratio is "safe", it is rising and will continue to rise, given the historical pattern of ratios surging after economic crises, Li said.

Li made the remarks at the 37th annual conference of the International Organization of Securities Commissions in Beijing.

He said the most fundamental way to deal with the problem and avoid systemic risks is to speed up the development of the capital market and ensure that companies can raise capital by other means than bank borrowing.

"For instance, the government should allow more companies to list their shares and issue corporate bonds, and it should promote the (use) of derivatives."

Concerns over banks' asset quality have been deepening since the government reported that China's economy grew 8.1 percent in the first quarter, the slowest rate in almost three years.

In addition, the growth rate of the government's total fiscal income, which would back up the financial system, dived to 6.9 percent in April from 18.7 percent in March and an average of 25 percent last year, according to a statement from the Ministry of Finance last Friday.

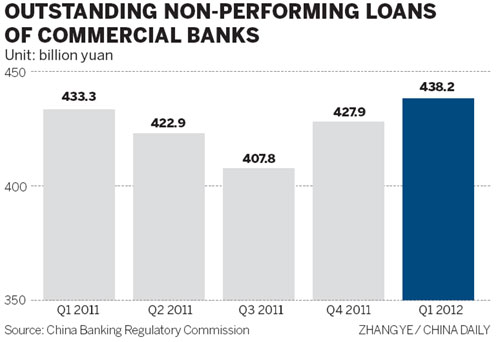

Commercial banks' outstanding NPLs increased for a second straight quarter for the first time since 2005, the China Banking Regulatory Commission said on Thursday.

Bad loans stood at 438.2 billion yuan ($69.5 billion) at the end of March, up 10.3 billion yuan from three months earlier. The NPL ratio narrowed to 0.9 percent of total lending, however, from 1 percent in December.

NPL risks could be lower than expected this year, said May Yan, director of Barclays Capital Asia Ltd. Banks are at the beginning of a rising non-performing loan cycle.

However, official data show that they have built up strong buffers to absorb increased credit costs, said Hu Bin, a Moody's vice-president and senior analyst.

China's non-performing debt and special-mention loans (those that might turn bad) were "vastly understated" and banks' cushions are "thinning as deposit growth slows and forbearance reduces loan repayments", Fitch Ratings was quoted by Bloomberg as saying.

Yuan-denominated deposits among the lenders shrank by 465.6 billion yuan in April, while they extended 681.8 billion yuan in new loans in the month, according to the central bank.

wangxiaotian@chinadaily.com.cn

(China Daily 05/18/2012 page13)