No hard landing for economy: KPMG report

KPMG LLP, the global accounting firm, said it does not see a hard landing ahead for China's economy, and has predicted that the economy is set to see stable growth in the second half of 2012.

In its latest research on China's economic globalization, the firm said that Chinese companies have transferred their merger and acquisition ambitions to European and American markets, mainly targeting investment in the energy, power and mining industries.

Peter Fung, global chairman of KPMG Global China Practice, which provides consulting services to Chinese companies investing abroad, said that emerging Chinese enterprises are now shifting their attention to technology investment, and targeting markets in developed economies.

The report said that China's outbound M&A activity is now taking place in 34 countries, and the United States and Canada received the largest investment flows in the first half of the year.

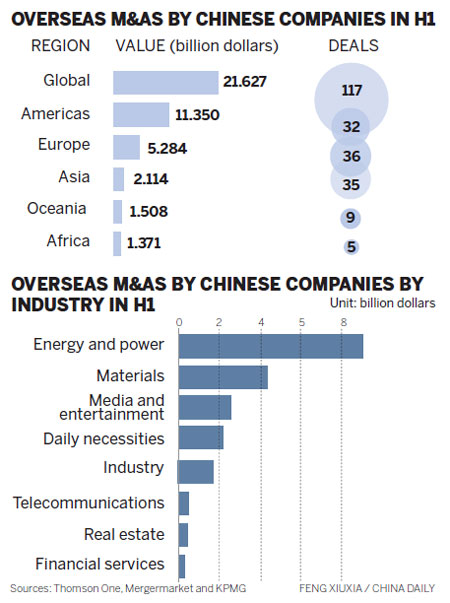

It said that 117 overseas M&A deals by Chinese enterprises were announced during the first half of the year. Some 87 of the deals disclosed had a combined transaction value of $21.63 billion.

"Thanks to the rebound in investment and export demand in the first half of the year, we don't see a hard economic landing in China," Fung said, adding that the economy is likely to see stable growth in the second half of the year.

"Yuan appreciation, government policy encouragement and financial crises in Europe and the US, which reduced purchasing cost, have been the impetus for China to accelerate its overseas M&A," Fung added.

The report showed that China's M&A targets were mainly concentrated in developed countries in Europe and America, but that North America attracted the largest share.

Transactions in North and South America accounted for more than half the total number of deals, followed by Europe's 24 percent, according to the report.

The US received the largest amount of Chinese overseas investment, at a total investment value of $5.74 billion, 27 percent of all investment overseas.

For the first six months, China's non-financial outbound investment reached $35.42 billion, increasing 48.2 percent year-on-year.

Energy and power received the largest amount of investment by Chinese purchasers, having nearly $9.2 billion worth of disclosed projects.

Of the deals in those two areas, 61 percent were in the oil and natural gas businesses, having transaction values of $5.54 billion.

The Wall Street Journal reported recently that a Chinese group - that includes the major oil company Sinopec - is now in advanced talks to put up to $1 billion in a Texas clean energy project, in what would mark one of the biggest investments by Chinese companies in the US power sector.

Energy sector deals noted in the report included China Petrochemical Corp's (Sinopec) highly significant $2.44 billion acquisition in April of a third share in the US-based Devon Energy Corp's five shale gas assets - a move which analysts said marks the company's first serious foray into oil and gas exploration and development in the US.

It was also notable, given Devon's proficiency in producing oil and gas from shale and other unconventional basins, as China moves to develop sources of clean energy.

Another industry cited as being at the top of the target list for Chinese investors was media and entertainment.

Special mention was given in the report to the property conglomerate Dalian Wanda Group Corp's move in May to buy the US theater chain AMC Entertainment Inc for $2.6 billion - considered the biggest overseas acquisition by Chinese companies during the first half of the year.

Wang Jianlin, president of Wanda, said the purchase will help develop Wanda into a truly global cinema owner.

Compared with the uptrend for M&A activity, China's use of foreign investment has headed in the other direction, noted the report.

For the fist six months, China's FDI dropped 3 percent year-on-year, which the report attributed to the European debt crisis, increased cost of production and the weak real estate market.

Peng Yali, head of research at KPMG Global China Practice, said: "Despite a decline in value, the structure of China's capital inflow is evolving toward industrial optimization and this is in line with the goal of attracting foreign investment, which improves business conditions and drives sustainable development."

baochang@chinadaily.com.cn

(China Daily 08/16/2012 page13)