Private equity firms heeding call of services industry

|

A mother and her daughter learn about summer vacation tutoring in Jinan, Shandong province, in July. Chinese parents pay more attention to children's education and are willing to afford private tutors for their children. Liang Zhijie / for China Daily |

As millions of consumers climb into China's middle-class, investors are looking for opportunities in services with unexploited mass-market potential.

Wang Chaoyong, chairman and CEO of China Equity Group Inc, a Chinese private equity firm, has been trying for the past three years to get involved in a greater variety of projects.

"Among the 35 companies in our portfolio, about a quarter are already consumer-related," he said.

It has been a happy change in strategy so far, Wang said, noting that State-owned companies do not enjoy monopolies in the retail and consumer services industry, as they do in many other lines of business in China.

Among privately owned companies in the industry is the Beijing-based Longwen Education Group, a company that helps parents manage their children's after-school studies. Of the 450 million yuan ($72.29 million) in private equity investments it had received by the end of 2011, 360 million yuan came from China Equity.

That constituted the largest investment a private equity firm has made in the educational services industry, Wang said.

"Opportunities emerge in all industries," he said. "But we chose only the top three to five players in each industry as the potential targets of our investment. Once we decide to work with them, we offer them not only capital but also value-added services."

It used to be that only well-to-do families could afford private tutors for their children in China. Longwen is designed to offer instruction to small groups or in one-on-one sessions.

Through more than 30 years of reforms, China has made huge progress in raising the general welfare of its people, Wang said. The country's per capita GDP was $5,432 in 2011, up from $1,135 in 2002.

With that increase in resources, he said, many more households can afford the products and services, ranging from better cars, cosmetics clothes to healthcare and schooling, which used to be only within the reach of a small number of people.

Fortune from education

Wang said Longwen will mainly use China Equity's investment to expand its network of study centers and hire more teachers.

Longwen Education was founded by its current CEO, Yang Yong, about 10 years ago. Wang said the company operates on a different business model from New Oriental Education and Technology Group Inc, which is perhaps the best-known company in China's education services market.

New Oriental, which was listed on the New York Stock Exchange in 2006, primarily helps Chinese students prepare for foreign language tests. Longwen, in contrast, concentrates on providing after-school help.

Yang said he wants the company to be the market leader for after-school teaching and customized education, which he believes will be worth between 300 billion yuan and 500 billion yuan by 2020.

In many Chinese families both parents have jobs, giving them little time to help their children with homework. Study centers offer an alternative means of providing that assistance.

Longwen's centers are places where students will encounter not only tutors but also opportunities to hone their musical and artistic abilities.

Wang said it's important to avoid having great distances separating study centers and students' homes. Longwen's service has thus had to make use of an extensive and tightly-knit network in every city where it is offered. It's in the ability to manage that network that "Longwen has carved out its niche", Wang said.

The company has opened about 200 study centers in Beijing alone. But that's still not enough to offer its services in every corner of the capital.

Across the country, the company had 1,200 study centers in 55 cities by the end of May.

"What we have here is a national brand that is able to build up its following wherever it goes," Wang said.

Longwen recruits its teachers from teachers' universities and trains them according to its own standards. Of the 12,000 teachers it employs in China, 500 have retired from public schools, where they received government awards in recognition of their performance.

The company now runs three centers where teachers are trained.

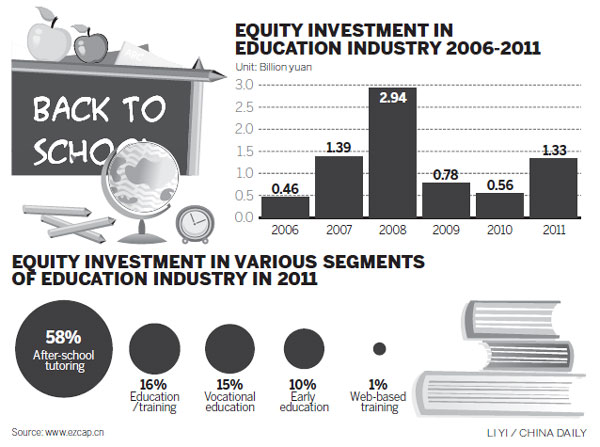

Li Feng, a partner at IDG Capital Partners and a former senior executive at New Oriental, said education services were less affected than other industries by the recent world financial crisis and have become particularly attractive to investors.

At the same time, he said education service providers aren't often among those who see a quick expansion of their business.

Sun Tao, managing director for greater China of the global private equity company Providence Equity Partners LLC, argues that China's education services are still in an early stage of development. If the government policies that govern the industry were liberalized, many new investment opportunities would arise.

"For instance, Chinese parents always pay more attention to children's education and expect them to go to all of the best schools in the world," he said.

Sun was a former partner at Actis Capital LLP, another private equity firm, which made a $50 million investment in 2008 in Ambow Education Holding Ltd, a company that helps young Chinese go to better schools and obtain more attractive jobs. Ambow was listed on the New York Stock Exchange in 2010.

Wang said China Equity has amassed a fairly diversified portfolio in preparation for the day when domestic consumers will be the main pillar of China's economy.

Besides Longwen, it has also invested in the sportswear maker Anta Sports Products Ltd and the hair stylist chain Tony Studio. These companies hail from industries that are vastly different from telecommunications and banking, in which China Equity won its first successes. Wang said entrepreneurship and branding carry more weight in consumer industries.

Only the owners of existing leading brands have had an opportunity, through working with financial investors for five to seven years, to become large enough to be listed on the stock market or arrange significant mergers with other companies, Wang said.

"This is exactly what our strategy is."

(China Daily 11/28/2012 page16)