Nation now world's major target for M&A growth-market activity

China became the prime investment destination among key growth markets in 2012, as the Chinese middle class rises and foreign investors get more familiar with mergers and acquisitions here, according to international law firm Freshfields Bruckhaus Deringer.

"The continuing desire for foreign multinationals to tap into China's growing middle-class consumers has been a significant driver in making China a leading destination for M&A for a number of years," Robert Ashworth, managing partner at Freshfields Asia, told China Daily.

Ashworth added that foreign investors are becoming increasingly familiar with the M&A process in China.

"Activity levels in China, in particular, rebounded well, and it is likely that China will continue to lead in the coming two years," said Ashworth.

He also said that many companies see the higher growth markets as their best option for securing longer term increases in productivity and profitability. So higher levels of M&A activity are expected in Asia in 2013 across most sectors.

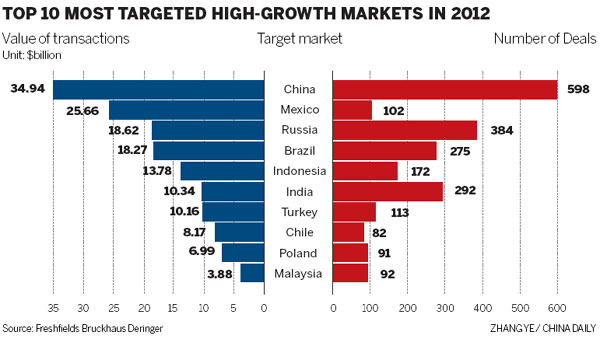

According to a Freshfields report released on Monday, China attracted almost $35 billion of fresh inward M&A investment, up 3 percent year-on-year, helping the country secure its position as the most sought-after investment destination for the third time in the last five years.

China was followed by Mexico with $25.7 billion and Russia with $18.6 billion.

In terms of deal volume, China also took the first position with 598 transactions compared with Russia, in second place, with 384 deals.

Popular sectors of the Chinese M&A market included metal, mining and telecoms.

The report focused on 24 economies designated as emerging and developing by the International Monetary Fund, including China, Brazil and Russia.

The value of global M&A investments targeting these key growth markets rose 5 percent year-on-year in 2012 to $162.4 billion. The figure follows a drop of almost 25 percent recorded in the previous year.

The US led the ranking of the most active investors in growth markets, followed by Belgium, Hong Kong and Singapore. Notably, on a volume basis, Hong Kong took second place with 324 deals.

The report showed that the US made the highest amount of investments in these markets since 2007, an increase of 70 percent year-on-year to over $13 billion.

caixiao@chinadaily.com.cn

(China Daily 01/29/2013 page13)