G8 leaders seek deal to curb tax evasion

World leaders at the G8 summit declared on Tuesday that governments must work together to close loopholes that allow multinational corporate giants to avoid paying taxes in their home countries.

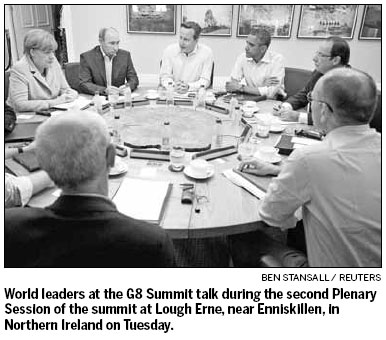

British Prime Minister David Cameron, host of the two-day G8 summit at a remote lakeside golf resort in Northern Ireland, promised "significant developments on tax" in a tweet before heading into a morning discussion on the subject with the leaders of the United States, Germany, Russia, France, Italy, Canada and Japan.

British lawmakers have sharply criticized Google, Starbucks and other US multinationals operating in Britain for exploiting accounting rules by registering their profits in neighboring countries such as Ireland, which charges half the rate of corporate tax, or paying no tax at all by employing offshore shell companies.

But Britain itself stands accused of being one of the world's premier links in the tax-avoidance chain. Several of the UK's own island territories - including Jersey, Guernsey and the British Virgin Islands - serve as shelters and funnel billions each week through the City of London, the world's second-largest financial market.

"Of course Britain's got to put its own house in order," said Britain's treasury chief, Chancellor of the Exchequer George Osborne, who was invited to address the G8 meeting on corporate tax reform. Before the summit, Britain announced a provisional agreement with the finance chiefs of nine of its offshore dependencies to improve their sharing of information on individuals and companies banking cash there.

Minimized tax bills

Many of the world's leading companies, ranging from Apple to the management company of U2, employ complex corporate structures involving multiple subsidiaries in several countries to minimize the tax bills in their home nation. One such maneuver, called the "double Irish with a Dutch sandwich" allows foreign companies to send profits through one Irish company, then to a Dutch company and finally to a second nominally Irish company that is headquartered in a usually British tax haven.

The US said it was committed to reforming the global accounting rules and collecting more of US companies' profits banked outside US shores.

"The goal of cracking down on tax avoidance, bringing greater transparency to it, this is something we've pursued in the US, and we agree with Prime Minister Cameron that we can work together multilaterally to promote approaches that achieve those objectives," said Ben Rhodes, US President Barack Obama's deputy national security adviser.

No more ransoms

Meanwhile, G8 leaders have agreed to stamp out the payment of ransoms for hostages kidnapped by "terrorists", Cameron's office said on Tuesday.

Downing Street said the world leaders would also call on companies to follow their lead in refusing to pay for the release of abductees.

"Leaders agree to stamp out payment of ransoms to terrorists and call on companies to follow their lead," Cameron's office said on its Twitter feed.

British officials said Cameron had been keen to push the deal because funds raised by ransom payments were the main source of funding for terror groups, especially those in North Africa.

Britain was particularly focused on the subject following a hostage crisis at a gas plant in Algeria in January in which 37 foreign hostages were killed, among them six Britons.

Hostage taking was worth $70 million to al-Qaida-linked groups around the world over the last two years, British officials said.

AP-AFP

(China Daily 06/19/2013 page11)