The first ministerial review of the country's income tax system has recommended that the current tax threshold be maintained, despite repeated calls to raise the level to ease the burden on a growing number of middle-income families and stimulate domestic consumption amid the economic downturn.

"Raising the tax threshold will eventually harm the interests of low-income families and the needy," the report said.

Some experts did not agree with the ministry's latest report and continued to urge authorities to raise the tax threshold to lighten the tax burden on middle-income households.

"It is not reasonable for Chinese wage earners to continue contributing half of the total income tax revenue," Zhang Peisen, a senior researcher with the Taxation Research Institute under the State Administration of Taxation, told China Daily yesterday.

China's personal monthly income tax threshold was increased from 800 yuan ($117) a month in 1980 to the current 2,000 yuan, meaning that workers with a monthly salary of 2,500 yuan or less do not pay any taxes after social insurance deductions.

Presently, those earning 10,000 yuan a month will pay 825 yuan of tax.

Based on tax regulations, those who earn higher salaries would stand to benefit more from a higher threshold than those who made less, the report said.

Income tax paid by the country's rich, or those with more than 120,000 yuan in annual income, also accounted for 35 percent of total taxpayers' contributions to the national coffers, the ministry review reported.

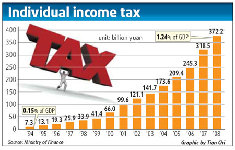

Tax from income grew by 34 percent since 1994 to become one of the major sources of tax revenue for the country. Total personal income tax revenue rose from 7.3 billion yuan in 1994 to 372.2 billion in 2008, taking up 1.24 percent of the country's GDP and 6.4 percent of the total tax revenue.

The average annual income for urban residents was 15,781 yuan in 2008, while those in China's highest income bracket held a total of about 8.8 trillion yuan in equity, or 29 percent of the country's 30-trillion-yuan GDP in 2008, according to the China Private Wealth Report 2009.

The number of China's wealthiest, or those who own about 9 trillion yuan ($1.29 trillion) in private equity, is also expected to expand to about 320,000 people by the end of 2009, the report said.

Most of the taxpayers are from middle-income families and their total earnings are less than that of rich people, so they should not pay so much tax, Zhang said.

"The most direct way to reduce their burden is to raise the income tax threshold," he said.

"But the tax rate system can be reformed after the threshold is raised to increase the tax revenue."

Other economists pointed to other benefits of raising the threshold.

"Raising the taxable personal income threshold will spur consumption and help the economy recover from the global financial crisis," said Zhang Xiaojing, director of the department of macroeconomics of the Institute of Economy under the Chinese Academy of Social Sciences.

Zhang Ran contributed to the story