L'Oreal looking pretty in the Chinese market

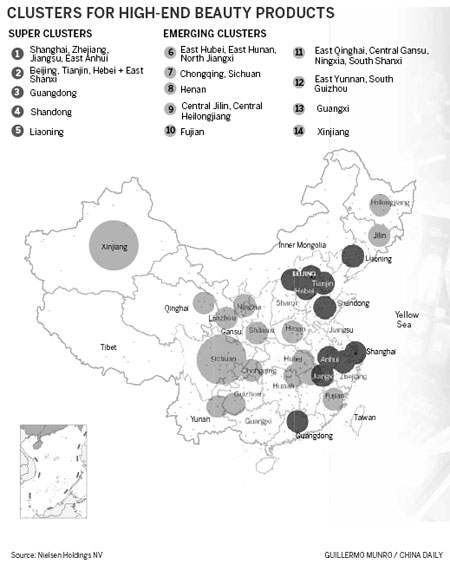

Last year, L'Oreal said that taking its Luxe unit to an increasing number of lower-tier cities will be the company's focus in the coming years.

"Our ambition with our beauty brands is to capture the growing Chinese middle class," said Rinderknech. "First-tier cities are important, however, more potential comes from lower-tier cities."

According to L'Oreal's data, people in first-tier cities consume 3.6 beauty products per person per year, on average, while those in third-tier cities buy 1.1 products and consumers in fourth- or fifth-cities purchase 0.4.

Nielsen also found that high-end cosmetics and beauty products have 16 percent of the overall market share in first-tier cities, while the share is below10 percent in lower-tier cities.

Though Rinderknech said that customers in higher-tier cities are more used to luxury brands and have more choices than those in lower-tier cities, she added that L'Oreal has noticed that those differences are getting smaller as many Chinese customers are traveling abroad and have higher expectations for luxury products.

Previously, Chinese customers were mostly looking to gain status and get recognition from others when choosing luxury brands. However, today they want brands that they know and that they like, Rinderknech said.

"This is a fantastic opportunity for us as we position each of our luxury brands to be desired by each Chinese customer and create a strong emotional connection," Rinderknech added.

Distribution channels

According to Yang at Nielsen, consumers in first- or second-tier cites can buy their favorite luxury cosmetics from diverse distribution channels, from brand boutiques, shopping mall counters, beauty chain stores, to duty-free shops at domestic and international airports.

However, "the current distribution channels in lower-tier cities cannot satisfy the consumers' desire for beauty," said Yang.

International brands "have conquered higher-tier cities, as local consumers spend 45 percent of their beauty budgets on foreign brands, while the figure is only 21 percent in lower-tier cities," she added.

To gain market share in lower-tier cities, Yang suggested boosting the presence of brands as the first step to approach local consumers.

"Also, the brands should pay attention to consumer habits and local environments in different markets to fine-tune products and sales strategies," said Yang.

"We bring luxury beauty products to people who used to travel far to get them," Rinderknech added.

For the different brands under L'Oreal umbrella, "the plans vary depending on each of our brands and its development stage, while the intention remains the same: conquer the rising middle class in China".

According to Rinderknech, Armani Cosmetics, which is distributed by L'Oreal, is already building a super-premium image in first- and second-tier cities, where it's "building desirability for its best-selling skincare product Crema Nera. Third-tier cities will follow when both the brand and its customers are mature enough".

Another L'Oreal brand, YSL Beauty, which was launched in May in Shanghai will be first established in higher-tier cities and will then be launched in lower-tier cities.

"I could say the same about Helena Rubinstein. The brand's mission is to offer the best premium skincare products with the best service to the most demanding customers," said Rinderknech.

"It takes very long to find and to train our beauty advisors so that they can provide the unique level of service that goes with our best innovations. We cannot compromise on our service quality, therefore although we would like to offer the brand to a larger number of customers in lower-tier cities, we must take our time to do things perfectly," Rinderknech explained.

Another example is Clarisonic, which L'Oreal launched with partner Sephora in January 2013 and is present in all Sephora stores.

"Sales in top-tier and lower-tier cities were well-balanced, which was quite surprising to us," Rinderknech said.

Meanwhile, online sales among young people are booming, especially in lower-tier cities, Yang at Nielsen said.

Rinderknech said that "the rise of digital is helping us to build better brand awareness in lower-tier cities".

For instance, a brand like Kiehl's, the American cosmetics brand that is the fastest-growing brand in the Chinese market, is very popular in lower-tier cities.

"Chinese digital platforms allow the buzz about brands to circulate in no time and accelerate the construction of brand awareness, which makes an exciting brand like Kiehl's already known and strongly desired in many places in China," said Rinderknech.