HSI plunges on Dubai debt default fears

Updated: 2009-11-28 07:05

By Lillian Liu(HK Edition)

|

|||||||

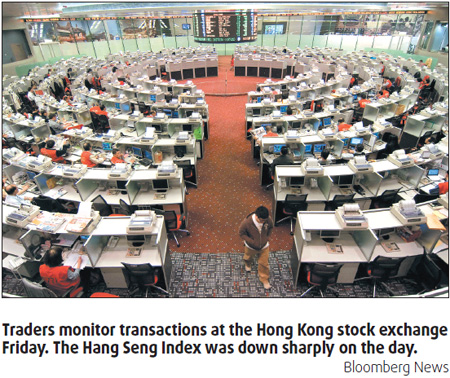

HONG KONG: Shock news from Dubai sent Hong Kong stocks plummeting more than 1,000 points Friday, the most in a single day since March, as investors hastily dumped their holdings in Asian banks and builders on fears that a Dubai debt default may trigger another credit crisis.

The benchmark Hang Seng Index plunged 1,075.91 points, or 4.84 percent, to close at 21,134.5 points, tombstoning a week in which the gauge closed and fell 5.9 percent.

Dubai, part of the oil-exporting United Arab Emirates, said on Wednesday it would ask creditors of state-owned Dubai World and Nakheel to agree to a standstill on billions of dollars of debt as a first step towards restructuring.

Market watchers said if it turns out that the city state should be unable to pay the debt, many world leading banks will suffer great losses.

Dubai World, the conglomerate that led the emirate's expansion, had $59 billion of liabilities as of August, which accounted for most of Dubai's total debt of $80 billion. Nakheel was the builder of three palm-shaped islands off Dubai.

Concerns about Dubai's potentially crippling default on enormous debts to global creditors have rattled investor confidence, analysts at Calyon Bank said in a report.

The Dubai crisis could have a "meaningful impact" on banks across Asia, said Daniel Tabbush, an analyst at CLSA, said Standard Chartered, HSBC and Singapore's DBS Group are the most exposed in the region.

HSBC Holdings, which is among Dubai World's creditors, fell 7.6 percent to HK$87. Standard Charter Pl, which reaps its revenue mostly from emerging markets, decreased 8.62 percent to HK$185.5. Shares in Hong Kong developers fell around 4 percent. PetroChina, the country's top oil company, ended 4.96 percent lower to HK$9.38 after crude prices fell.

The stock market turmoil is an important reminder that the credit crisis is forgotten but not gone, analysts say.

CLSA Asia-Pacific Markets cut its rating on Standard Chartered to "underperform" from "buy", saying "capital raisings cannot be ruled out by either bank due to this, but especially Standard Chartered," according to a research note.

However, Castor Pang, director of research at CINDA International Holdings, thinks investors have over-reacted as HSBC and Standard Chartered's exposure to Dubai is not as big as investors expected.

"At the moment it doesn't seem that the two banks' exposure to Dubai is that great," he said.

The pessimistic market sentiment sent all member stocks of Hang Seng Index to end lower Friday.

Industrial and Commercial Bank of China, the world's largest bank by market value, fell 5.3 percent to HK$6.26, widening its losses in the past four days to 10 percent. Bank of China Ltd, which said this week it is studying "various options" to replenish capital, sank 5.1 percent to HK$4.13. The stock has tumbled 14 percent in the past four sessions.

(HK Edition 11/28/2009 page5)