Mortgage size and length hit 10-yr high

Updated: 2010-10-27 07:00

By Oswald Chen(HK Edition)

|

|||||||

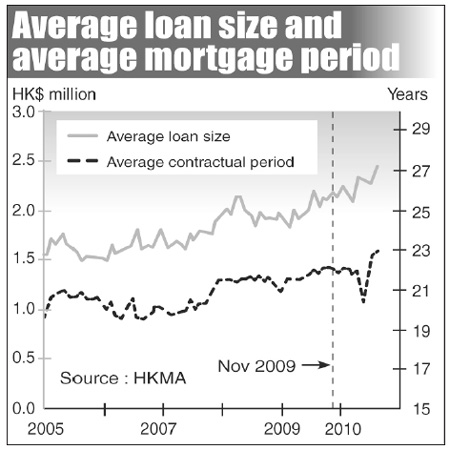

Average loan at HK$2.5m; loan period at 23 yrs

Mortgages in the city have reached a 10-year high in terms of average loan size and contract length, the Hong Kong Monetary Authority (HKMA) reported Tuesday.

The average loan size is HK$2.5 million and the average contract period for a mortgage is 23 years. The HKMA submitted the report to the Legislative Council (LegCo) ahead of the LegCo Panel on Financial Affairs meeting to be held on November 1. HKMA Chief Executive Norman Chan will attend the meeting to explain the report's findings further.

However, the HKMA said that the asset quality of local banks has also improved as relevant benchmark figures are at comfortable levels compared with historical standards.

For example, the current residential mortgage loan (RML) delinquency ratio has dropped to 0.02 percent compared to the historical high of 1.43 percent. The current number of negative equity RMLs has also plummeted to 310 cases, compared with the historical high of 105,697 cases.

Nevertheless, the report issued a note of warning about the 10-year high levels for the size of mortgage loans and length of contracts. With the local mortgage rate hovering just below 2.5 percent; the mortgage repayment-to-income ratio for both the mass and luxury market has reached 40 percent and 70 percent respectively. This could create a problem for buyers if home prices fall or interest rates rise.

The prices of local luxury and mass residential homes have already risen more than 45 percent since the 2008 financial crisis. And in the case of luxury flats, prices are also 14 percent higher than the previous peak of 1997. For mass residential flats, prices are just 10 percent lower than their 1997 peak period. The HKMA reiterated that it will continue to monitor local banks to ensure that they comply with measures regarding residential mortgage lending announced in August.

However, Billy Mak, associate professor of finance at the Hong Kong Baptist University said that the harmful effects of a sliding local property market on the banking sector may be exaggerated.

"If the local banking sector is to be negatively affected by falling property prices, it must fulfill three conditions: local home prices must fall more than 30 percent, home owners are incapable of repaying their mortgage loans, and local banks are generally undercapitalized," Mak said.

He added that this is unlikely to happen in the near future as the property market lacks supply and local banks are generally well capitalized by international standards.

According to the report, the liquidity ratio of retail banks is about 39.5 percent, well above the requirement of 25 percent. Regarding the mortgage repayment-to-income ratio of 40 percent in the mass residential market, Mak said that this is still affordable for local mortgage loan borrowers.

China Daily

(HK Edition 10/27/2010 page2)