Yuan loans 30% cheaper in city

Updated: 2010-10-29 08:30

(HK Edition)

|

|||||||

Competitive rates, savings benefit mainland firms

The 130 billion yuan ($19 billion) of savings in Hong Kong's banks is making it cheaper for mainland companies to borrow yuan-denominated loans in the city rather than back home.

China Automation Group Ltd will pay 4.6 percent interest for three and a half-year yuan funding in the first syndicated loan arranged in Hong Kong using the currency, according to Chief Financial Officer Cui Dachao. A similar-maturity loan on the mainland would cost as much as 6.6 percent, the company said.

"Borrowing yuan in Hong Kong is much cheaper than on the mainland," Cui said Thursday in a phone interview from Beijing. The maker of safety control systems for the chemicals and rail industries is arranging a $40 million facility, of which the yuan loan is a part.

"Hong Kong is cheaper than the mainland because on the mainland the loan interest rates are controlled," Allen Xu, head of loan syndication and project finance at Bank of China Ltd, said in a phone interview from Beijing.

Regulatory approval to repatriate yuan funds to the mainland is given on a case-by-case basis, limiting the ability of many mainland companies to take advantage of the cheaper funding in Hong Kong, according to Zhang Zhiming, head of China research at HSBC Holdings Plc in Hong Kong.

"The companies have the incentive to go offshore but whether they can take the money back is subject to approval," he said.

Lending in yuan outside the mainland is a step in Premier Wen Jiabao's efforts to open the country's financial market while seeking to avoid currency gains that would jeopardize growth in the nation of 1.3 billion people.

Though the rate on China Automation's loan is 2 percentage points less than a similar-maturity loan on the mainland, it's still 1.6 percentage points more than what Houston, Texas-based Patterson-UTI Energy Inc pays on credit with a similar maturity.

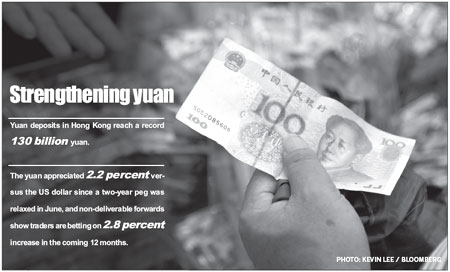

Yuan deposits in Hong Kong doubled to a record 130 billion yuan in the first eight months of 2010 on anticipation of currency gains, the Hong Kong Monetary Authority, the de facto central bank in the city, said earlier.

"Hong Kong residents are buying yuan, and bank deposits are growing," Mitul Kotecha, the Hong Kong-based head of global foreign-exchange strategy at Credit Agricole CIB, said in a phone interview. "The mainland wants to use Hong Kong to help internationalize the yuan, and there's also this expectation the yuan will strengthen."

The yuan appreciated 2.2 percent versus the US dollar since a two-year peg was relaxed in June, and non-deliverable forwards show traders are betting on 2.8 percent increase in the coming 12 months.

Yuan appreciation will benefit China Automation and any other mainland borrowers who buy raw materials from suppliers using dollars, an added incentive.

Bloomberg

(HK Edition 10/29/2010 page3)