HKMA warns of asset bubble

Updated: 2010-11-02 07:10

By Oswald Chen(HK Edition)

|

|||||||

Chan: We will act on threats to banking system

Hong Kong Monetary Authority (HKMA) Chief Executive Norman Chan said Monday that the local asset market is overheating and that there will eventually be a correction.

He also said that the city's de facto central bank will take further measures to limit property lending if it results in speculation that could endanger the stability of the local banking system.

Chan made the remarks at the Legislative Council (LegCo) Panel Meeting on Financial Affairs.

"The imminent launch of the second round of the quantitative easing policy (QE2) in the US has unleashed many side-effects upon the financial systems in emerging markets such as Asia, and it is expected that these side-effects will be strengthened," Chan said. "We expect asset market correction will happen and bring greater shock to the local financial system if it does."

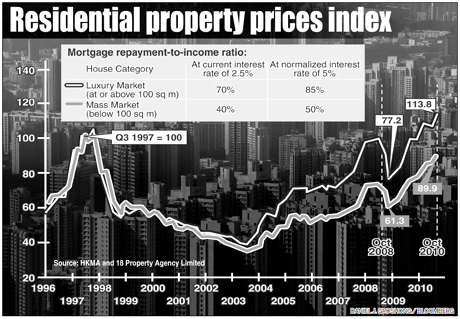

Chan said that the measures on mortgage lending introduced by the government in the middle of August had a cooling effect on the property market with both transaction prices and sales volume down in September. However, the property market picked up steam again in October with transaction prices and volume increasing.

"As we do not have the complete figures for October, we still need time to gauge the current situation of the local property market. If the property speculation lending becomes dominant, HKMA will introduce further measures to safeguard the stability of the local banking system," Chan said.

However, Chan said that the risk of an asset bubble, particularly in the local property sector, is increasing because of low interest rates, ample global liquidity and the buoyancy of the local economy.

Chan admitted that under the current Linked Exchange Rate System, the government lacks the mechanism to fine-tune the asset market by changing interest rates or exchange rates. Nevertheless, Chan still believes it is the best system for the city.

"If the currencies peg system is abolished, more capital may be attracted into the city as global investors may exercise interest arbitrage in the foreign exchange market to generate returns," Chan said. "As a result, the local asset market will attract even more capital."

But according to Cheng Yuk-shing, an associate professor of economics at Hong Kong Baptist University, the risk of a local asset bubble forming is on the rise because under the Linked Rate Exchange System, the city is unable to either raise interest rates or appreciate the currency to contain capital inflows. He said that the government must do more to tackle the problem before it leaves lasting damaging effects on the local economy.

"Take the property market, for example," Cheng said. "The administration needs to ensure even more land supply, or further tighten the downpayment ratio for mortgage loans - or even forbid foreigners to purchase any property in the city in order to contain skyrocketing property prices."

Alan Luk, head of investment and advisory at the Hang Seng Bank, told China Daily that he expects the city's asset market to remain buoyant.

"As the market envisages that the US, Europe and Japan are to resort to ultra monetary policy easing to boost economic growth in the next 18 months, asset prices are still expected to continue to rise," Luk said.

He added that although property, stocks, bonds and gold are likely to see a market correction, investors still feel it is better to hold on to their assets since interest rates in the city are so low.

He added that despite the asset bubble that is forming, investors are also concerned about focusing on returns that will be able to outperform inflation.

China Daily

(HK Edition 11/02/2010 page2)