IMF: Asset bubble looming if house prices not reined in

Updated: 2010-11-19 08:03

By Joy Li(HK Edition)

|

|||||||

US monetary expansion and credit growth adding fuel to the fire

US monetary expansion imported across the Pacific due to Hong Kong's currency link and credit growth directed at the property sector are increasing the risks of a bubble in the city's housing market, the International Monetary Fund (IMF) said Thursday.

Nigel Chalk, the IMF's mission chief for the Hong Kong SAR and senior adviser in the Asia Pacific department, said price hikes in the city's property market were concentrated in the luxury segment, which has risen to a level 10 percent higher than its previous peak in 1997. Furthermore, rising prices have filtered down to the mass market as well and are fast approaching peak 1997 levels, Chalk added.

According to data compiled by Midland Market Property, a local real estate agency, the average property price in the city increased 16 percent from HK$4,313 per square foot in October 2009 to HK$4,998 per square foot in October this year. The trend has been in a steep upward trajectory since the end of 2008.

"Right now we see no asset bubble in Hong Kong, as the property market is consistent with Hong Kong's economic fundamentals. However, if the trend of rising prices continues and misaligns from economic fundamentals, it will become a real concern," said Chalk.

For now, however, he added that tight land supply, low interest rates, rising incomes and rising rents all justify the increase in housing prices.

Meanwhile, Hong Kong's fixed exchange rate system - or currency peg - with the US dollar means that the city essentially imports the interest rates set by the Federal Reserve, currently very low. So in effect, Hong Kong can't raise interest rates to counter a housing bubble and inflation.

"Our concern isn't now, it's a prospective concern," Chalk said. "You could end up where the property market starts to deflate, prices going down, but payments on household mortgages are going up. It becomes harder to pay your mortgage on an asset that has less value." He warned that failing to prevent a fast rise in prices now could result in a very nasty shock later.

However, the IMF does not believe that scrapping the US dollar peg is the right move. According to its latest report, it says the peg remains a "robust anchor of monetary and financial stability." Crucially, so does the Hong Kong Monetary Authority, which said it has no intention of tampering with a system that has served the city well for 27 years. There has been speculation lately that the Hong Kong government is considering ending the US dollar peg in a bid to curb the inflow of hot money and imported inflation.

Instead, the IMF has recommended that the government use the full range of credit and fiscal tools it has at its disposal, despite not being able to set interest rates.

It said the government should curb more credit from flowing into the property market by further lowering loan-to-value ratios. Lending in September was 18 percent higher than a year ago and around a half of all new lending in Hong Kong has been directed at the property market, the IMF said.

It also thinks the government should further increase land supply, consider raising stamp duties on home purchases, and increase property tax rates on high-end properties.

"We will remain vigilant and continue to deal with the challenges created by the exceptionally accommodative monetary policies in developed economies," Hong Kong Financial Secretary John Tsang said in a statement Thursday after the IMF's comments.

In terms of the city's overall economic conditions for 2010 and beyond, the IMF commented that "the Hong Kong economy is now back onto a robust growth trajectory with the key sources of demand firing on all cylinders."

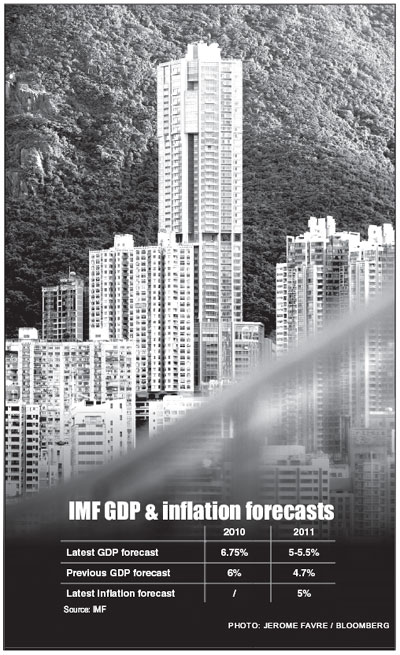

The IMF raised its Hong Kong GDP growth forecast for 2010 and 2011 to 6.75 percent and 5-5.5 percent, respectively, compared with 6 percent and 4.7 percent previously. The Hong Kong government also raised its full year GDP forecast last week to 6.5 percent from its previous estimate of 5 to 6 percent.

The IMF predicted that inflation in Hong Kong can be expected to reach around 5 percent by the end of 2011, double the government's 2010 forecast of 2.5 percent. Chalk said that higher property prices leading to higher rents will be a primary contributing factor to the Consumer Price Index. He added that the recent surge in food prices on the mainland is also likely to have a direct impact on the city as well.

Dow Jones and the FT contributed to this story.

China Daily

(HK Edition 11/19/2010 page2)