Worries on capital outflows overdone: Analysts

Updated: 2010-11-27 07:04

By Joy Li(HK Edition)

|

|||||||

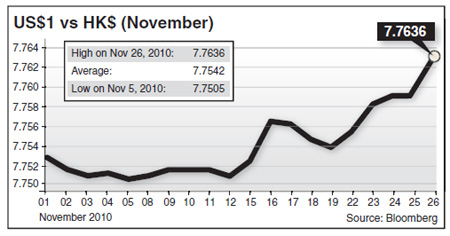

The Hong Kong dollar has weakened against the US dollar recently, causing worries about capital outflows, which in turn have contributed to the slump in the equity market. However, experts believe that the worries may have been overdone as the money outflow is small and likely to be temporary.

The Hong Kong dollar traded at around HK$7.7636/US$ on Friday, down from HK$7.7505/US$ on November 5, or 0.02 percent.

Mark Wan, chief analyst at Hang Seng Investment Services Ltd, thinks that the decline reflects only the limited amount of capital outflow that occurred, as the dip was quite minor in comparison with other currencies in the region, such as the yen and the Australian dollar.

He attributed the reason for the collective drop across the board to worries about events this week on the Korean Peninsula, where an exchange of fire occurred Tuesday.

The yen declined to JPY83.81/US$ Friday from JPY80.74/US$ on November 4, down 4 percent. The Australian dollar slipped to AU$1.0352/US$ from AU$0.9852/US$ over the same period, down 5 percent. The value of the euro was also trimmed, as northern Asia is Europe's major export market. The euro fell to EUR0.7543/US$ from EUR0.7035/US$ over the same period, down 7 percent.

Wan sees no extreme volatility of the Hong Kong dollar in the near term, as confidence about the mainland's economic growth will continue to attract foreign investors, who are now playing the "China story" through the city.

Catherine Cheung, head of investment strategy and research at Citibank Global Consumer Group, does not believe that a capital exodus is forming and that the market is just undergoing a temporary adjustment.

The benchmark Hang Seng Index has fallen 8.4 percent to 22,877.25 at the close of trading Friday from the year-to-date high of 24,964.37 on November 08.

According to Cheung, inflows into equities have resumed after a brief outflow last week. For the week ended Wednesday, there were widespread inflows into all regional funds, albeit moderate. Flows were focused on global emerging market funds.

China funds received $360 million for the week, of which the majority went to H-shares and red-chip exchange-traded funds (ETFs), according to a Citibank report. Inflows into China picked up sharply, investors appear to have put behind the inflation and interest rate hike concerns, buying into weakness on China equities, Cheung noted.

Over the past week, the average daily turnover at the local stock exchange was below the HK$100 billion achieved in the previous week. But Cheung said that this was because investors turned cautious as the stock market had been riding too high.

Historically, stock market returns tend to be higher from November to January, as "buy-low" opportunities appear, said Cheung. Citibank has set an index 2011 target of 26,500. The Hang Seng Index closed at 22,877 Friday, down from 23,054 the day before.

China Daily

(HK Edition 11/27/2010 page2)