Credit Suisse sees 20% HSI upside

Updated: 2010-12-02 07:46

By Emma An(HK Edition)

|

|||||||

|

A man stops to look at a bronze statue of a water buffalo outside the Hong Kong Stock Exchange. Credit Suisse expects the Hang Seng Index to rise to 28,900 points by the end of 2011. Dennis Owen / Bloomberg |

Ample liquidity, economic growth are key factors

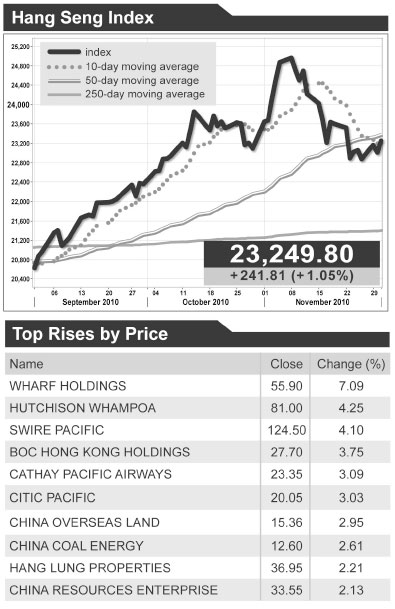

Credit Suisse said Wednesday that it remains bullish on its outlook for the Hong Kong stock market. It forecast upside of 20 percent next year, citing ample liquidity due to low interest rates, economic growth and increasing inflationary pressure.

The bank expects the benchmark Hang Seng Index (HSI) to rise to 28,900 points by the end of 2011 from 23,250 at the end of Wednesday's trading session.

Besides support from ample market liquidity, Credit Suisse also cited undemanding current market valuations as contributing to the upside.

The benchmark is currently trading at 12.8 times forecast earnings for 2011, lower than the historical average of 14.3 times, Credit Suisse's analyst team noted in a research report released Wednesday.

"Generally, we remain bullish towards the Asia market," Sakthi Siva, chief equity strategist for Asia Pacific at Credit Suisse said Wednesday at a media briefing on the latest report, noting that she expects a 20 percent rally in the MXASJ (MSCI Asia excluding Japan) index in 2011.

The analysts are particularly upbeat on Hong Kong's property and transportation sectors. "We overweight the property and transportation sectors for 2011," analysts led by Siva say in the report, "We expect the best hedge for the expected asset inflation to be the developers and the landlords."

The analysts are expecting Hong Kong's inflation to accelerate to 5.2 percent by the end of 2011 from 2.3 percent this year. Higher rentals and rising food prices will be the major factors fueling the upward pressures on CPI, the report said.

The first three quarters have seen an average of 20 percent year-on-year increase in the city's rentals. From now until the end of 2011, the bank expects to see a 30 percent rise in Hong Kong's property prices.

But the analysts are not so enthusiastic about the city's banking sector. "We underweight the banks, as we believe the loan growth in 2011 is likely to be hurt by the government's close monitoring of the banks' lending exposure," they noted in the report.

In apparent attempts to fence off anticipated risks to lenders and to help quell speculation on the red-hot real estate market, the Hong Kong Monetary Authority, the city's de facto central bank, has tightened banks' credit to home buyers recently, including tighter down payment requirement for mortgage applicants.

Credit Suisse also cited a profit-margin squeeze for its dislike of banks. "Without imminent interest rate hikes, we believe the net interest margin of the banks will continue to be weak," they added.

Real interest rates now stand at negative 2.3 percent in Hong Kong. But the damage is not just to the banks. "To keep the real interest rate within this negative regime has created asset bubbles one after another," Vincent Chan, equity research managing director at Credit Suisse said at the briefing.

Credit Suisse rated the consumer sector as "neutral" despite the fact the sector could benefit from inflation. "It is not that we do not think the consumer sector will not benefit from the inflationary environment, especially the high-end segment. It is the limited scope of investible and relevant stocks that makes us maintain our neutral view there," the report said.

Economic growth will slow down from 6.8 percent in 2010 to 4.8 percent in 2011, according to the bank's forecast. The decline may not really be bad news as long as the economy is still growing. "Economic growth is not a problem," Chan said.

China Daily

(HK Edition 12/02/2010 page3)