Jones Lang LaSalle: 35% upside for office rents

Updated: 2010-12-08 07:03

By Joy Li and Oswald Chen(HK Edition)

|

|||||||

Office rents in the city are expected to rise 30 to 35 percent in 2011, on the back of a vibrant economy leading to sustained company expansion and new set-up demand, according to a forecast by real estate consultancy firm Jones Lang LaSalle.

Overall net take-up of office space amounted to 3.38 million square feet during the first 11 months, and is expected to reach 3.7 million square feet for the whole year, the highest annual level in a decade, data compiled by the company released Tuesday showed.

As of the end of November, the overall vacancy rate was down to 4.2 percent, compared with 7 percent as of the end 2009. Among various districts, the biggest drop was observed in Kowloon East, down to 6.8 percent from 19.9 percent compared with the same period last year, the company noted.

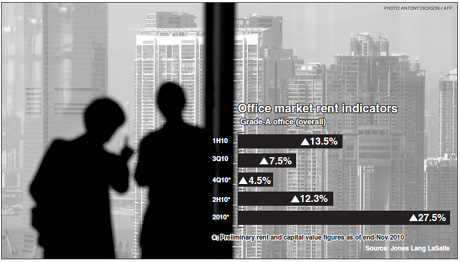

With falling vacancy rates, landlords have become more aggressive in raising rents. In the first 11 months of 2010, overall Grade-A office rents rose by 27.5 percent, with those in Central rising by 33.3 percent.

"The trend of decentralization will likely continue as space availability in the core submarkets declines and as emerging submarkets like Kowloon East continue to mature," said Gavin Morgan, Jones Lang LaSalle head of markets in Hong Kong.

Morgan expects rents in Central to rise 25 to 30 percent to a level of HK$90 per square foot, and those in Kowloon East to rise 35 to 40 percent to a level of HK$33 per square foot in 2011.

As for the residential market, the company expects a noticeable drop in the number of transactions in 2011, due to the measures taken last month by the government to curb speculative activity in the property sector.

In the first 10 months of the year, over 12,425 new residential units were sold in the primary market, amounting to 77 percent of total sales in 2009. Joseph Tsang, head of capital markets at Jones Lang LaSalle, expects the sales volume to drop in 2011 to between 7,000 and 8,000 units.

However, limited supply and a low interest rate environment will sustain modest price growth of 5 to 10 percent next year, Tsang added.

Prices in the mass residential market are still 16 percent below their peak level in 1997 even after a 19.2 percent jump over the past 11 months, he said.

Meanwhile, Vincent Chan, an executive director at Midland Holdings, the largest listed real estate agent in the city, said he remains optimistic about the outlook for the property market next year. He cited tight supply, negative real interest rates, strong economic growth as well as demand from mainland buyers.

Buggle Lau, chief analyst of Midland Realty, has forecast an 11 percent price rise in residential flats next year.

China Daily

(HK Edition 12/08/2010 page2)