OTC derivatives regulation to tighten

Updated: 2010-12-11 08:19

By Emma An(HK Edition)

|

|||||||

HKMA sets up a central registry to enhance transparency, reduce risk

The Hong Kong Monetary Authority (HKMA) said Friday that it will set up a central registry by the end of 2012 for derivative trades in the over-the-counter (OTC) market to enhance transparency and reduce counterparty risk.

Financial institutions incorporated in Hong Kong will be required to report all their OTC derivatives transactions to the central registry, called the trade repository (TR), which will run an electronic database to keep a record of those transactions. Financial institutions incorporated overseas will also have their Hong Kong-related OTC transactions put on file.

The information gathered by the TR will help regulators more efficiently monitor and regulate market activity.

At the same time, Hong Kong Exchanges and Clearing Limited (HKEx), operator of the local bourse, will be operating a central counterparty clearing facility (CCP), a clearing platform, for the OTC derivatives transactions.

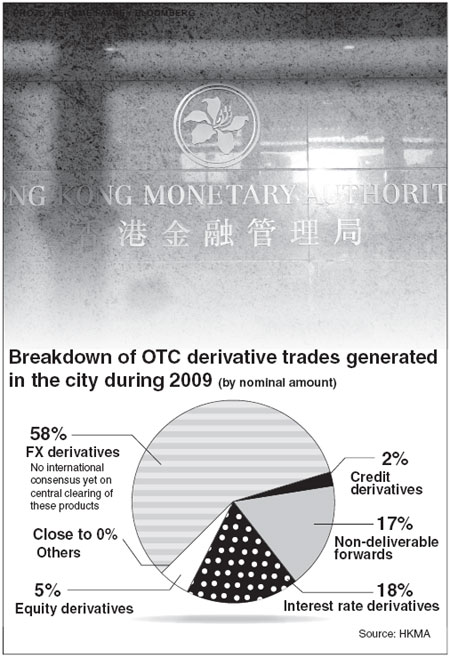

Under the new regulatory setup, all financial institutions are required to clear their standardized OTC derivatives contracts with CCP. Initially, the requirement will only apply to interest rate swaps and non-deliverable forwards, which accounted for 18 percent and 17 percent, respectively, of the total OTC derivatives trades in the city in 2009. In the future, HKEx said that it expects to handle other derivatives such as equity derivatives.

"While this is a relatively low-volume market in Hong Kong at the moment, it has tremendous potential for growth, particularly with the wider use of renminbi in international transactions," HKEx Chief Executive Charles Li said.

CCP will complement the TR by feeding it information on derivatives contracts cleared through the facility.

The new regulatory framework is designed to honor a commitment agreed by the G20 to keep in check derivatives trades that have become obscure and risky due to lack of transparency, a problem that is seen as contributing to the global financial crisis.

"The lack of market transparency and robust clearing and settlement infrastructure in the OTC derivatives markets was highlighted as a source of instability in the recent financial crisis," Eddie Yue, deputy chief executive of the HKMA, said Friday at a media briefing.

The new reporting and clearing requirement is supposed to ameliorate the problem. "The local TR and CCP are crucial for enhancing the robustness and transparency of the local OTC derivatives markets, bringing Hong Kong's financial market infrastructure in line with global standards," Yue added.

Dickie Wong, research director at Kingston Securities Ltd agreed that the regulatory regime will serve as a "growth driver" for the city's OTC derivatives market.

In terms of the volume of the OTC derivative transactions, Hong Kong has long lagged behind overseas markets, Wong suggested. However, "the new regulatory practice will help Hong Kong to finally catch up with overseas markets," said Wong.

China Daily

(HK Edition 12/11/2010 page2)