City to remain top IPO market in 2011

Updated: 2010-12-22 07:07

By Emma An(HK Edition)

|

|||||||

Ernst & Young estimates local bourse to attract HK$400 billion

Hong Kong is likely to remain the top IPO market in 2011 and will raise an estimated HK$400 billion, a research report released Tuesday by Ernst & Young shows.

The local IPO market is also on course to claim the world's top spot for a second year in succession in 2010 with total funds raised to be in the neighborhood of HK$450 billion.

Fundraising activities gathered pace globally this year, with $255 billion raised in 1,199 IPOs worldwide during the first 11 months of 2010. Ernst & Young is expecting total funds raised by IPOs worldwide to hit $300 billion by year end, a sharp increase compared with the $133 billion raised last year and surpassing the peak level previously reached in 2007 of $295 billion.

"Despite a downturn in European markets, it is heartening to see that global IPO activity has returned to pre-financial crisis levels," Dilys Chau, assurance partner at Ernst & Young said Tuesday at a media briefing.

As fundraising activities heat up, Hong Kong looks set to echo the hottest IPO market, buoyed by the mega IPOs of the Agricultural Bank of China and AIA Group, the Asian life insurance business spun off from the US insurance corporation American International Group (AIG).

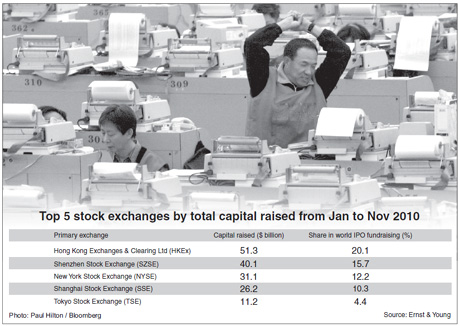

With a total $51.3 billion raised during the first 11 months of 2010, the Hong Kong Stock Exchange accounts for around one fifth of the total funds raised in IPOs worldwide, followed by Shenzhen and New York with $40.1 billion and $31.1 billion respectively, during the same period. The AIA Group's Hong Kong listing, the second largest of the year, raised $20.5 billion. The Agricultural Bank of China, dually-listed in Hong Kong and Shanghai, set the IPO record with a total $22.1 billion raised.

"It has been a good year for IPO fundraising activity. We expect total funds raised this year to reach HK$450 billion, a 81 percent increase compared with HK$249 billion raised last year," said Chau, noting that the fourth quarter is normally the busiest season for IPO activity.

Next year may not see as much funds raised this year in the absence of mega IPOs, but it will still be strong as a growing number of companies are aiming for listings in Hong Kong, according to Ringo Choi, regional managing partner for China South at Ernst & Young.

"Despite market uncertainty, new IPO filings continue to increase around the world and a large backlog has built up as companies await greater macroeconomic stability. Therefore, we expect the current IPO momentum to continue in 2011," said Choi.

As before, Chinese companies will be driving growth, Choi noted. However, new growth will also be seen in the number of companies from the rest of the world seeking listings in Hong Kong, according to Choi.

"We expect that IPO activity in 2011 will continue to be strong. While mainland companies will continue to be the major driver for IPO activity in Hong Kong, we will also see more and more listings of companies from both the developed and emerging markets, as Hong Kong Stock Exchange has become a hub for cross-border IPO activity," said Chau.

China Daily

(HK Edition 12/22/2010 page3)