BEA 2010 net soars 62% to HK$4.2b

Updated: 2011-02-16 07:11

By Emma An(HK Edition)

|

|||||||

|

A branch of the Bank of East Asia (BEA) in Hong Kong. The company announced a total dividend for 2010 of 94 cents per share. Jerome Favre / Bloomberg |

Company reports record earnings as income rises and bad loans decrease

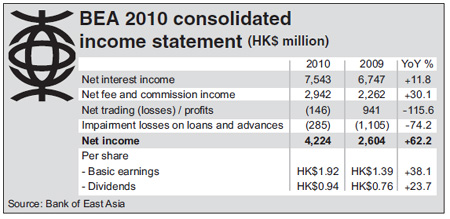

Bank of East Asia Ltd (BEA) said Tuesday that its net profit for 2010 surged 62 percent to a record HK$4.22 billion, thanks to an increase in fee and net interest income as well as lower bad loan costs.

The bank's basic earnings per share rose to HK$1.92 from HK$1.39 a year earlier. The board also proposed a final dividend of 56 cents per share, bringing the total dividend for the year to 94 cents per share, compared with a full-year dividend of 76 cents in 2009.

"Our business performance was strong across the board. Not only is our profit at a record high, we set new records for total assets, total loans outstanding and total deposits," Chairman and Chief Executive David K.P. Li said at a press conference Tuesday announcing the annual results.

BEA's assets totaled HK$534 billion at the end of 2010, up 23 percent compared with a year earlier. Total loans jumped 19.9 percent year-on-year to hit a new high of HK$297 billion in 2010, thanks to the booming lending market in Hong Kong, according to the chairman. Total deposits amounted to HK$425 billion at the end of 2010, an increase of 23.2 percent compared with 2009.

Meanwhile, the lender's capital adequacy ratio, which stood at 13.2 percent at the end of 2010, is at "a healthy ratio" and will be "sufficient" to support the bank's "controlled growth strategy in the medium term", Chief Financial Officer William C.M. Cheng said. Chairman Li said the bank has "no fundraising plans at the moment".

Compared with overseas markets, which remain challenging amid the lingering European sovereign debt crisis, the mainland and Hong Kong markets were the two main growth drivers for the lender.

"With the Hong Kong economy expanding by more than 6 percent in 2010, and the mainland by more than 10 percent, these two markets powered our growth last year," said Li.

BEA generated a net interest income of HK$7.54 billion in 2010, 11.8 percent more than 2009. Total non-interest income rose by 4.1 percent year-on-year to 3.58 billion, mainly helped by a sharp rise of 30 percent in the net fee and commission income, which totaled HK$2.94 billion as of the end of 2010.

Progress was also seen in the bank's management of its credit risk, which helped see a drop of 74.2 percent in its impairment losses from loans and advances to HK$285 million. The overall impaired loan ratio was 0.54 percent at the end of 2010, down from 0.99 percent at end-2009.

For 2011, BEA will continue to expand its mainland presence to capture the growing wealth of its clients there, according to the chairman. The number of outlets on the mainland, which stood at 90 at the end of 2010, is expected to exceed 100 by the end of 2011, he said.

"Our mainland client base is generating an increasing amount of referral business for our Hong Kong and overseas operations. These referrals were a major contributor to the growth in new loans during 2010," said Li. Business channeled through BEA's mainland subsidiary accounted for 24 percent of the corporate and commercial loan and trade finance portfolio of its Hong Kong business as at the end of 2010.

However, its mainland business may be facing mounting cost pressures, noted Brian M.B. Li, the deputy chief executive who also heads the mainland subsidiary. Apart from higher costs arising from the opening of new outlets and growing labor costs on the mainland, there will also be increasing capital needs as mainland subsidiaries try to refrain from aggressive loan growth in order to achieve a loan-to-deposit ratio of 75 percent by the end of 2011, a requirement for all foreign banks operating on the mainland. The ratio was 78 percent at the end of 2010.

BEA also expects to benefit further from the fast-growing offshore yuan business. According to another Deputy Chief Executive Adrian M.K. Li, BEA currently makes up 5 percent of the offshore yuan market in Hong Kong. The bank is expecting yuan business margins to improve as the yuan bond market expands and the pool of yuan funds grows.

"Renminbi business is promising," Chief Operating Officer Tong Hon-shing said. However, "at the very beginning, we look more at volume growth rather than profitability growth," he added.

China Daily

(HK Edition 02/16/2011 page2)