ICBC net rises 28% on margin expansion

Updated: 2011-03-31 07:05

By Oswald Chen(HK Edition)

|

|||||||

|

Jiang Jianqing, chairman of Industrial and Commercial Bank of China Ltd, attends the company's annual results news conference in Hong Kong on Wednesday. The bank said its business risk from lending to local governments is under control. Jerome Favre / Bloomberg |

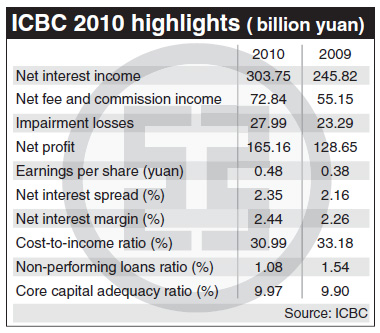

The Industrial and Commercial Bank of China (ICBC), the world's largest listed bank by market capitalization, on Wednesday posted a net profit of nearly 166 billion yuan, an increase of 28.3 percent. The bank cited margin expansion as a key contributing factor.

The lender also declared a final dividend of 0.184 yuan per share, up 8.23 percent from a year ago.

ICBC was the last lender among the mainland's four major State-owned banks to release its results.

The bank attributed the increase in net profit not only to widening of its net interest margin, but also to a surge in net fees and commission income from its asset management business.

According to ICBC, its net interest margin in 2010 reached 2.44 percent, representing a 0.18 percentage point rise compared with 2009 due to an interest rate hike on the mainland and the lender's approach in asset and liability management.

Net fee and commission income jumped 32.1 percent to 72.8 billion yuan whereas revenue from its asset management business grew 53 percent. Net fee and commission income in 2010 represented 19.13 percent of the lender's total operating income, which also registered a 1.31 percentage point increase from 2009.

Separately, ICBC President Yang Kaisheng reiterated that the business risk from lending to local governments is under control.

"ICBC's current outstanding loans to local government financing vehicles are valued at 515.1 billion yuan whereas 63 percent of the loans can generate cash flows to repay the principal and interest. Moreover, the bank has earmarked a special provision of 19.5 billion yuan for local government lending which should be adequate to cover any unexpected losses," Yang said in Beijing.

Local governments on the mainland are not permitted to sell bonds or lend directly from banks so that recently they have set up thousands of local government finance platforms to raise capital from the market.

According to the ICBC statement, the bank's non-performing loans (NPL) ratio on lending to local governments was 0.3 percent at the end of 2010. It also said the same ratio for personal mortgages stood at 0.4 percent, while the ratio on lending to real estate developers was at 0.88 percent at the end of 2010. The lender said that it expects to maintain its NPL ratio at below 1.1 percent for 2011.

Yang stressed that the recent hikes in the required reserve ratio (RRR) as well as interest rates should not exert a serious negative impact on the bank's future profitability.

The mainland has raised the RRR six times and increased interest rates three times since October 2010 to slow economic growth following a $2.7 trillion credit boom over the past two years.

The RRR now stands at a record high of 20 percent for larger banks and 18 percent for smaller banks. Economists predicted that the tightening move will soak up liquidity of around 350 billion yuan and it is predicted that there will be one more RRR hike and two more interest rate hikes in the first half of 2011.

The ICBC Wednesday statement said that the bank's provision coverage ratio rose to 228.2 percent, a 63.8 percentage point increase year-on-year.

"Besides maintaining adequate provision coverage ratio, ICBC is also prudent in containing excessive loan growth. ICBC's loan growth in 2011 is targeted at a growth rate of 13.2 percent to 14.2 percent, which is equivalent to new lending amounting to 820 to 880 billion yuan," ICBC Chairman Jiang Jianqing said at the Hong Kong press conference.

Reuters contributed to this story.

China Daily

(HK Edition 03/31/2011 page2)