IPO market still healthy but challenges looming

Updated: 2011-06-30 08:07

By Emma An(HK Edition)

|

|||||||

Deloitte expects slower H2 growth, despite stellar proceeds so far

"Big four" accounting firm Deloitte said on Wednesday that despite Hong Kong posting the best IPO fund-raising interim performance in the past 10 years, it doesn't expect total 2011 proceeds to match that of last year.

A total of HK$182.2 billion ($23.4 billion) was raised from 33 initial public offerings deals in the first half of this year, Deloitte said.

The accounting firm expects the volume of deals to slightly increase this year - to about 100 compared with 95 last year - but the capital raised to decrease about 11 percent to HK$400 billion from HK$449 billion in 2010.

Deloitte expects less big deals to be cut this year, citing AIA as an example of such last year. AIA, the Asian life assurance business of AIG, raised HK$159 billion through its Hong Kong IPO in October 2010.

It also cited challenges in the second half as another obstacle. According to the firm, risks include tightening monetary policies to tame inflation, a potential slowdown of the US economy, and loss of business with international companies choosing to list in Shanghai instead.

Edward Au, national co-leader of the public offering group at Deloitte China, described the city's IPO market in the first quarter as being relatively quiet, with only 10 deals completed, as investors were concerned about the crisis in Japan and political risk in the Middle East. But market sentiment has been recovering since, with big names like Glencore and Prada coming onto the market in the second quarter.

"In the first half, the IPO market shrugged off the impact from risk factors, such as global stock volatility, the European debt crisis and political unrest in the Middle East. Investors were also spooked by the devastating earthquake in Japan, as well as inflation pressure and macro control policies on the mainland," Au said at a media briefing.

With HK$182.2 billion raised, which was 2.6 times more than that raised during the first half of 2010, Hong Kong ranked second only to the New York Stock Exchange in terms of funds raised globally in the first half of 2011, followed by Shenzhen Stock Exchange with HK$140 billion, London Stock Exchange with HK$130 billion and Shanghai Stock Exchange with HK$60 billion.

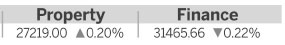

The retail and consumer sector saw the highest number of IPOs in the first half as international players such as Prada and Samsonite tapped the market one after another in order to be closer to millions of Chinese consumers and investors. As before, most of the money raised during the first half came from the listings of energy and resources companies. Such companies together accounted for 51 percent of the total HK$182.2 billion raised. The dual listing of Glencore International PLC in London and Hong Kong in May, which raised a total of HK$77.7 billion, represents the largest IPO globally so far this year.

Deloitte sees active IPO activities in the second half particularly in three sectors, namely retail and consumer, energy and resources, and financial services. According to Au, banks and insurance companies will feel the urge to raise funds as they move to meet the higher capital and liquidity requirements set by the People's Bank of China.

The accounting firm also predicts a growing number of international listings this year in the city's capital market, which already dominated the top five largest IPOs during the first six months. The second half will likely see 10 more such listings, according to Au. Meanwhile, Au said he expected to see one or two more yuan-denominated IPOs towards the year end, following in the footsteps of the Hui Xian REIT.

emmaan@chinadailyhk.com

China Daily

(HK Edition 06/30/2011 page2)