Prudential interim earnings climb 25%

Updated: 2011-08-06 06:59

By Emma An(HK Edition)

|

|||||||

Insurer attributes gains to revenue from its Asian and US units

Prudential Plc, the UK's biggest insurer by market value, said Friday its first-half profit rose 25 percent on revenue increases from its Asian and US units.

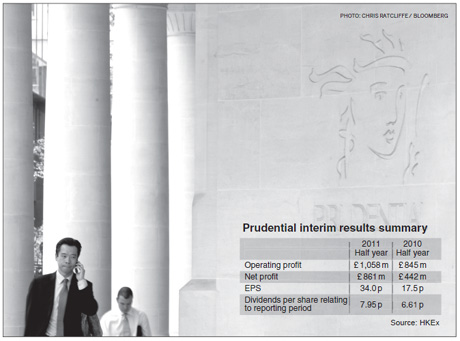

The company recorded an operating profit of 1.06 billion pounds sterling ($1.73 billion) up 25 percent from 845 million pounds the previous year, the London-based insurer said in a statement on Friday that was posted on the Hong Kong Stock Exchange.

Annual premium equivalent sales, a gauge of revenue which includes all annualized first-year premiums and 10 percent of single premium products, stood at 1.8 billion pounds, a 10 percent rise year-on-year.

The company said it will boost its first-half dividend by 20 percent to 7.95 pence a share.

"We expect to see continued, profitable and cash generative growth in the second half of 2011," Chief Executive Officer Tidjane Thiam, said in Friday's statement. "We remain on course to deliver the 2013 profit growth and cash generation objectives."

Prudential, which generates almost half of its revenue from Asia, has set targets to double profit from the region within the next two years as it seeks to capitalize on the growing demand for insurance among the emerging and increasingly affluent middle classes in countries such as Indonesia.

Prudential's plans to become Asia's biggest insurer had been left in tatters after its $35.5 billion bid for AIA Group Ltd, the Asia life insurance arm of AIG based in Hong Kong, collapsed last year.

However, the company has been doing good business in many parts of Asia, particularly in Indonesia and Malaysia.

Prudential said its long-term operating profit from Asia jumped 24 percent to 326 million pounds in the first half as brisk businesses in Indonesia and Malaysia offset falling sales in India after that country's regulator demanded re-registration of all insurance products at the end of 2010.

"We have continued to concentrate on the fast-growing and highly profitable markets of Southeast Asia," Thiam said in the statement. He said the company's new business profit was up 17 percent in Asia and 22 percent in Asia ex-India.

Indonesia became Prudential's biggest market in Asia in terms of sales for the first time, the company said Friday. The profit of 95 million pounds in the first half was 36 percent more compared with the same period last year, outpacing the growth in the rest of Asia. Prudential currently has more than 100,000 agents in the country.

"There are clear macroeconomic concerns today in the Western world," Thiam said in the statement, pointing to Europe's debt woes and economic difficulties in the US. "While these issues may have some temporary adverse effects across the globe, we continue to believe that our substantial presence in the growing and developing markets across Asia put us in a position to deliver relative outperformance in the medium term," he added.

In the US, the world's largest retirement market where Prudential offers variable annuities, operating profit derived from long-term investment returns rose 13 percent to 368 million pounds in the first half. The insurer snatched market share from rivals during the credit crunch of 2008 by providing products that pay out regularly to retirees and that guard against financial losses caused when the stock market falls.

Prudential set itself ambitious profit targets last year and boosted its dividend after the failed takeover of AIA infuriated investors and led many to call for Chief Executive Tidjane Thiam and Chairman Harvey McGrath to resign. The aborted deal cost the company 377 million pounds in fees.

More than a fifth of shareholders voted against the reappointment of McGrath at Prudential's annual general meeting in May.

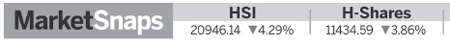

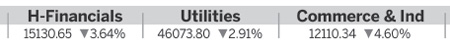

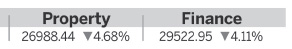

Prudential shares were down 2.62 percent at 613.50 pence at 12:00 pm in London trading (UK time), valuing the insurer at 15.59 billion pounds. Its share price in Hong Kong on Friday closed down 2.74 percent to HK$81.50 amid a broad market sell-off.

Bloomberg contributed to this story.

emmaan@chinadailyhk.com

China Daily

(HK Edition 08/06/2011 page2)