Stocks tumble amid China data, US debt

Updated: 2011-08-10 06:22

By Kana Nishizawa(HK Edition)

|

|||||||

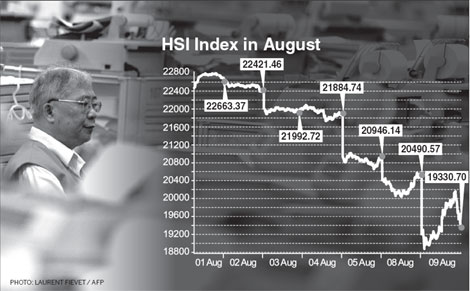

Hong Kong stocks tumbled on Tuesday, with the index sliding more than 20 percent from a November high, as a report showing inflation on the mainland accelerated added to concern the global economic slowdown may worsen in the wake of the US credit-rating downgrade.

The Hang Seng Index (HSI) slid 5.66 percent to 19330.70, falling 23 percent from November 8, entering what some investors define as a bear market. All but one stock in the 46-member gauge dropped. The Hang Seng China Enterprises Index fell 6.19 percent to 10426.07 after mainland inflation accelerated in July and industrial output rose less than estimated.

"The US simply lost credibility and the confidence of investors," said Francis Lun, managing director at Lyncean Holdings Ltd, an investment holding company in Hong Kong. "The market fell because the economic data from China raised exactly the bad news everybody didn't need. Inflation is still very high, meaning that the central bank may continue to tighten monetary policy." The market is seriously oversold, Lun also said.

HSBC slumped 7.3 percent to HK$66.40, the biggest drag on the HSI. Techtronic tumbled 7.5 percent to HK$6.71. Foxconn International slumped 6.4 percent to HK$3.36.

Futures on the Standard & Poor's 500 Index rose 0.3 percent on Tuesday. In New York, the S&P 500 plunged 6.7 percent on Monday, slumping 11 percent in three days, the most since November 2008. It fell to the lowest level since September 2010.

The Stoxx Europe 600 Index dropped 4.1 percent on Monday to the lowest level since August 2009 as S&P's downgrade of US sovereign debt overshadowed the European Central Bank's purchase of Spanish and Italian government bonds.

The HSI Volatility Index surged 45 percent to 51.97, indicating options traders expect a swing of 15 percent in the HSI in the next 30 days. The HSI swung 1290 points inintraday trading, the most since October 2008, according to data compiled by Bloomberg.

"It's a surprise to me to see such a panic selling in the last few days since the downgrade of the US credit rating," said Lewis Wan, chief investment officer at Pride Investments Group Ltd. "After the panic selling, investors will come to Asia to look for growth. The global growth story will be in Asia" as liquidity returns, looking for growth.

The gauge extended its loss near the close of trading after China's National Bureau of Statistics said the nation's industrial output rose 14 percent in July from a year earlier, missing the 14.6 percent median estimate in a Bloomberg survey of 23 economists.

Industrial & Commercial Bank of China Ltd lost 6.9 percent to HK$4.96. China Construction Bank Corp declined 7.3 percent to HK$5.22.

China's inflation rate accelerated 6.5 percent in July from a year earlier, exceeding the 6.4 percent median estimate in a Bloomberg survey of 26 economists. Producer prices rose 7.5 percent, matching the economist estimates.

The stronger-than-expected inflation data "and the likely gradual subsequent slowdown imply that Beijing will likely maintain its monetary tightening despite current global financial turmoil," Qu Hongbin, chief China economist at HSBC in Hong Kong, wrote in a report dated on Tuesday. "We still expect another two reserve-ratio hikes in the coming months."

Futures on the HSI tumbled 4.8 percent to 19411.

Bloomberg

(HK Edition 08/10/2011 page2)