KPMG downcast on banks due to liquidity, asset concerns

Updated: 2011-10-04 07:37

By Emma An(HK Edition)

|

|||||||

The outlook for Hong Kong's banking sector is clouded by some concerns including tight liquidity in the short term and asset quality worries in the medium term, according to a survey released by KPMG on Monday.

The accounting firm said in the latest survey that 2010 was marked by sustained loan growth, rising asset prices, low levels of bad debt and strong growth in the sale of investment products.

Total bank assets expanded 15 percent to HK$12.3 trillion ($1.58 trillion) during 2010, with new lending leaping by an impressive 29 percent.

Banks in Hong Kong have become somewhat reliant on strong loan growth to compensate for compressed net interest rate margins, Martin Wardle, head of financial services at KPMG in Hong Kong, wrote in the report.

Demand for loans continue to rise as cash-strapped mainland enterprises increasingly borrow in Hong Kong to take advantage of the lower funding costs and higher liquidity in the city as well as the expected depreciation of the US and Hong Kong dollars against the yuan. Local banks are also contending with the more pressing issue of tightening liquidity.

The growth in Hong Kong dollar deposits has so far lagged behind Hong Kong dollar loans as people favor the mainland's currency on the likelihood of its continued appreciation.

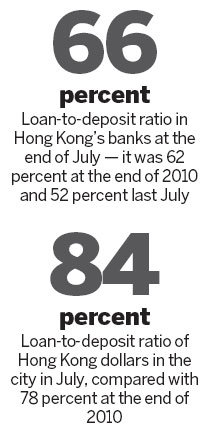

The more restrained growth in total customer deposits, which was 7.5 percent for 2010, shoved up the loan-to-deposit ratio to 62 percent at end-2010 from 52 percent the previous year. That ratio has further moved up to 66 percent for July 2011, while the loan-to-deposit ratio for the local currency increased to 84 percent for July from 78 percent at end-2010, data from the Hong Kong Monetary Authority shows.

The tightening of liquidity has "added to the upward pressure on deposit rates as lenders compete for funds" to meet the new capital rules under the Basel III and higher regulatory reserve ratios, Wardle suggested.

HSBC Holdings Plc's Hong Kong arm had a liquidity ratio of 39.3 percent last year, while the ratio stood at 38.1 percent and 34 percent for Hang Seng Bank Ltd and Standard Chartered Bank (Hong Kong) Ltd respectively.

The rapid pace of loan growth, coupled with the exceptionally low levels of loan impairment charges, has call into question credit quality, reckoned Wardle, referring to the increased risk of higher bad debt charges. Impaired loans, according to KPMG, represented less than 2 percent of the total lending by Hong Kong banks last year.

Currently, almost 25 percent of the total loan book is for use outside of Hong Kong. This significant mainland credit exposure was cited by FitchRatings in a note on Monday for creating "new risks" for Hong Kong's banking sector.

emmaan@chinadailyhk.com

China Daily

(HK Edition 10/04/2011 page2)