If central banks only get a BB gun while market expects a bazooka...

Updated: 2012-09-04 06:52

By Jimmy Cheung(HK Edition)

|

|||||||

Since mid-June, risk assets across the board have been buoyant for various reasons. One of the most dominant reasons is that central banks globally started hinting at another round of accommodative momentary policies in the face of poor economic readings and worsening debt woes in Europe.

Mario Draghi, the European Central Bank (ECB) president made a strong statement at an investment conference in London on July 26, 2012 pledging to do whatever it takes to save the Euro. Mr Draghi further announced that the ECB is considering some non-standard monetary policies after the Governing Council Meeting on August 2, 2012.

After Mr Draghi's speeches in the past two months, it was widely believed that the ECB would set a target yield range for short-dated Spanish and Italian government bonds and enforce this target yield range by purchasing enormous amount of these bonds in the secondary market. However, given the plan's structure and timing, I remain skeptical as to whether or not this grand plan will become a reality on time while the market is expecting it in a matter of weeks.

Firstly, if a target yield range is set, it literally means that the ECB will enter into an open-ended commitment to buy unlimited amounts of Spanish and Italian government bonds whenever the interest rate rises above the target range. Nonetheless, an open-ended commitment has been a taboo for the ECB since such a commitment would give rise to debt monetization and mutualization among member states in the currency bloc according to their stakes in the ECB.

Unlike the Federal Reserve in the US which only serves one single federal government. The ECB is held accountable to the 17 fiscally independent member states which are not supposed to share liability with each other.

While the eurozone is still at an early stage toward fiscal union, it is hard to believe that eurozone leaders would agree on re-distributing liability from debtor states like Spain and Italy to creditor states like Finland and Germany in an unfair manner at this point in time.

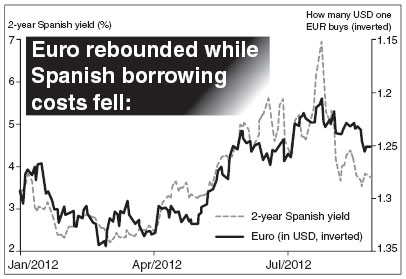

Secondly, I would argue that if the ECB and other policy makers have the sense of urgency to take this bold step when the capital market in Europe seems like it is returning to normality after Draghi's speeches in the past two months. The euro has rebounded from a multi-year low of $1.20 to the recent high close to $1.26 while the two-year Spanish yield dropped to below 4 percent from nearly 7 percent just a month ago (See chart). These market movements demonstrate not only improving signs of the debt crisis in Europe but also a high expectation of investors regarding upcoming policy responses.

Draghi's speeches have indeed succeeded in kicking the can down the road and calming the jittery market. If buying more time is ultimately what policy makers in Europe want to achieve, this goal is considered done. I expect the ECB meeting on September 6, 2012 is more likely to surprise to the downside, especially when investors have such a high expectation of it.

If the market is expecting a bazooka while the ECB can only provide a BB gun, disappointment among investors will be a sufficient reason to sink risk assets.

The author is a senior investment analyst at the Harris Fraser Group. The views expressed here are entirely his own and do not constitute any advice.

(HK Edition 09/04/2012 page2)