Debts piling up at China's industrial, coal firms

Updated: 2012-09-13 06:37

By Reuters(HK Edition)

|

|||||||

A 20 percent increase in the amount of money clients owe to companies in China's coal, steel and heavy machinery sectors is pointing to an industry-wide shakeout that threatens to put some smaller firms out of business.

Accounts receivable have risen sharply among China's publicly traded industrial companies as growth slows in the world's second largest economy, reducing manufacturing and the demand for a range of commodities.

Reuters examined balance sheets from 284 non-financial companies that are members of either the CSI300 index of the biggest Shanghai and Shenzhen listings or Hong Kong's Hang Seng Index. Accounts receivable at those firms rose by about 20 percent between December 2011 and June 2012.

The jump in unpaid bills has alarmed the government.

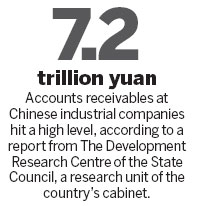

The Development Research Centre of the State Council, a research unit of China's cabinet, said in a report in March accounts receivables at Chinese industrial companies hit 7.2 trillion yuan ($1.13 trillion), and that the situation in the steel, coal and machinery sectors was especially "grave", according to state media.

Much of the money owed to large, state-owned companies in these sectors poses little threat because it is guaranteed by banks, but the rise in such accounts in smaller firms presents a huge and growing risk, analysts say.

"There are no signs of (an) economic recovery. The government is reluctant to implement any stimulus measures. The situation will get worse by the end of this year" and further deteriorate by the middle of next year, said Helen Lau, senior analyst at UOB Kay Hian (Hong Kong) Research who covers China's coal and steel sectors.

"A lot of smaller firms will default because they are financially weak and may not be able to get financing from banks. This is a natural market-driven market consolidation."

Worried by the March report, the cabinet has ordered various ministries to look into the issue. The ministries have yet to publish their findings.

According to Reuters data, the top 300 Shanghai- and Shenzhen-listed companies were owed a total $244.8 billion from their clients at the end of June, up from $204 billion six months earlier and about 18 percent higher than in June 2011.

Coal and construction firms recorded some of the largest increases in accounts receivable this year. Many of these firms said in their half-year earnings reports that the rise in accounts receivable was due to a slowdown in payment collection from clients, including local governments.

Joseph Ho, an analyst at Daiwa Capital Markets based in Hong Kong said the heavy machinery sector's outlook was negative due to rising accounts receivable and inventories, and weak market demand.

"It is a sector in which only the strongest can survive," he added.

(HK Edition 09/13/2012 page2)