'Superman' company directors in HK

Updated: 2013-01-18 07:01

By Li Tao(HK Edition)

|

|||||||

A study of 121 listed firms in HK reveals that executives on average serve as directors of at least three to four listed companies. But in one case, an executive serves on 17 companies' boards, raising question of effectiveness. Li Tao reports.

If you happened to receive a name card which is so informative that it has to be folded into two, don't take it as a vanity, as in some cases, it is really a necessity.

Take for instance, if an executive has a full-time job and who also serves 16 other companies as a consultant and supervisor at the same time, it is unlikely that he will be able to display all his 17 titles as well as other contact information in both readable Chinese and English characters on the two-sides of a normal-sized name-card.

This is also not a joke, or just a hypothesis. A study of business practices by Hong Kong Baptist University in November revealed that an independent non-executive director of a firm was found to be, at the same time, serving in the same capacity for 16 other companies, among the 121 listed firms in the city interviewed in the survey.

"He is a superman," Stephen Cheung, dean of Business School of the university which carried out the study, told China Daily in an interview, without disclosing the identity of the executive concerned.

"An independent non-executive director always has a regular full-time job which requires him to work at least eight hours for five days in a week. How could he possibly look after another 17 companies at the same time? Doesn't he sleep?"

The city's exchange, in its listing rules, requires a minimum of three independent non-executive directors on every board of a listed issuer, among whom at least one must have obtained appropriate professional qualifications or accounting or related financial management expertise.

New rule

From 2013, independent non-executive directors must represent at least one-third of the board of an issuer in the city, according to the rule, which, nevertheless, doesn't specify the responsibilities of the group of people in detail.

According to the fifth edition of "Guide for independent non-executive directors" published by The Hong Kong Institute of Directors in July, 2012, role of an independent non-executive director is to "supervise management, participate in the direction of company's business and affairs and speak out firmly and objectively on these and other issues that may come before the board".

The guidelines also require independent non-executive directors to "devote sufficient time" in a bid to attend all regular scheduled board meetings, review and consider prior to board meetings all papers and materials that are relevant.

"It is hard to imagine that these independent non-executive directors have adequate time to provide every company with professional oversight, suggestions, and guidance," commented the study by HKBU. "It is reasonable to assume that many companies meet this requirement in spirit only, because they employ only three independent non-executive directors."

Unlike many listed companies trying to limit the number of independent non-executive directors to the minimum allowed requirement, the independent non-executive directors are normally a lot busier considering that a majority of them are serving as directors on multiple boards of listed companies at the same time.

According to the study, an independent non-executive director of one listed company, on average, also sits on the board of three to four other companies in the city.

Nominal title

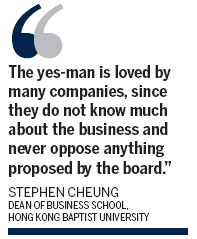

Cheung believes many of these directors are just taking a "nominal" title in some companies without knowing much about the business at all.

But these "nominal" titles do not come cheap, as some have quite expensive price tags. The annual income for an independent non-executive director averages about HK$200,000 in the city, with many of the bigger names such as HSBC Holdings PLC providing a million Hong Kong dollar-worth of remuneration package to these company supervisors and advisors.

Besides glamorous job titles and generous returns, the real nature of the position in some companies may further explain why many of these independent non-executive directors are not bored to sit on the boards of one firm after another, even if it is physically impossible for them to do so.

"The yes-man is loved by many companies, since they do not know much about the business and never oppose anything proposed by the board," said Cheung. "Some of them only need attend company meetings once in a while. (And) they could fall asleep there."

However, the Hong Kong stock exchange is not showing a total indifference to the issue. In 2010, the exchange carried out a consultation paper to review the code on corporate governance practices and associated listing rules, in which it sought market views on whether to introduce a requirement limiting the number of the independent non-executive directors' positions an individual may hold.

A year later, the exchange dropped this issue further given an overwhelming opposition from a majority of respondents.

Another major reason for opposing the amendments was that a limit could not be set because a person's available time and attention is affected by a range of factors, and an individual himself should determine whether he is able to devote the necessary amount of time and attention to an issuer.

Respondents also claim that an issuer's board will not appoint an individual unless it is satisfied that the candidate is suitable and will consider the number of directorships the candidate holds when considering him for a position. And by not imposing a limit, it may encourage a culture of professional directorships in Hong Kong, where more qualified and experienced individuals could build careers providing independent advice to board members, according to the exchange.

Multiple directorships

According to the list of board of directors of the Hong Kong stock exchange itself published on its website, among the 11 independent non-executive directors on the exchange's board as at July 3, 2012, 10 of them had multiple directorships.

Three of them had other directorships in more than six companies, with the highest one sitting on the boards of nine companies as an independent non-executive director.

Current level of corporate governance among Hong Kong-listed companies has upgraded significantly since 2009 with improvements seen from various aspects - including the optimized mechanism to allow minority shareholder's participation in voting procedures, leading to a more transparent corporate governance structure and disclosure of management's shareholdings to the public, according to the study of business practices by Hong Kong Baptist University.

"But room for perfection of the independent non-executive directors' practices in Hong Kong is also ample. There should be assessments or supervisions on the performance of these independent non-executive directors as well," said Cheung, who believes it is also vital in protecting the interests of shareholders as well as in further beefing up the corporate governance degrees of listed companies in the city.

(HK Edition 01/18/2013 page2)