Sportswear makers out of the woods

Updated: 2014-09-18 05:47

By Hua Yang in Hong Kong(HK Edition)

|

|||||||

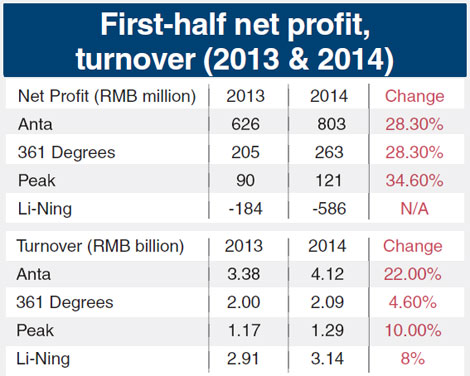

After two years of struggling to keep their businesses afloat, mainland sportswear makers are seeing the light at the end of the tunnel. Manufacturers are returning to profitability, with Anta Sports Products Ltd taking the lead with its first-half net profit rising 177 million yuan ($28.77 million) year-on-year, and Peak Sport Products Co Ltd recording 31 million yuan profit increases for the same period.

Several other mainland sportswear producers ended up in deep trouble after the 2008 financial crisis when demand for their products across the world fell far short of expectations.

Domestic brands saw a surge in their sales in the wake of the 2008 Beijing Olympics, with 2008 revenues at both Anta and Li-Ning Co Ltd, the two largest manufacturers, gaining more than 50 percent.

Fueled by the positive results, Li-Ning, Anta and smaller rivals Peak and 361 Degrees International Ltd opened a total of more than 9,000 stores across the mainland between 2008 and 2011 - an average of eight per day.

But, over-expansion and poor branding soon ate into their margins. In 2012, the industry entered a slump period. All listed brands suffered from sharp declines and their whole year net profits dropped, with Li-Ning reporting a net loss of 2 billion yuan.

Sportswear makers, who have since been recording poor results, have been making strategic shifts, culling stocks and closing stores.

Anta and Li-Ning have opened more self-owned stores instead of relying on wholesalers to distribute their products or franchising them to third parties.

"The wholesale mode in the sportswear industry is coming to an end, (and) retailing is the new trend," said Linus Yip, Hong Kong-based chief strategist at First Shanghai Securities.

By the end of June this year, Li-Ning's self-owned subsidiary stores accounted for 35 percent of the total number of outlets operated by the company - rising 16 percentage points from 19 percent two years ago.

"It was hard to react quickly to meet the demand from end-consumers because of the multiple layers of distribution of the wholesale model. With the retail-oriented model, we can directly monitor our sales and inventories," said Ding Shizhong, chairman and chief executive officer of Anta.

Anta's current inventories to sales ratio is four to one, which is considered to be healthy as it can both guarantee support for sales promotion and avoid sharp discount sales, Ding said.

Better shape

"Sportswear manufacturers are now in a better shape. There are growing signs (better profits, business improvement ratios and more orders) that retailers have emerged from years of massive over-supply even if competition remains intense," said Kenny Tang, general manager of AMTD Financial Planning Ltd.

Anta, the group leader, saw full recovery signs earlier this year, posting a 28.3-percent rise in its first-half net profit to 802.8 million yuan. Order value for delivery in the first quarter of 2014 maintained positive growth with a low double-digit increase year-on-year. "Positive growth for Anta will likely be sustained in the second half of the year," Ding said.

At both Peak and 361 Degrees, the interim results are back on a growth track. Peak reported a 34.6-percent increase in its 2014 first-half net profit to 120 million yuan, while 361 Degrees registered a turnover of 2.1 billion yuan for the first six months, an improvement of 4.6 percent, despite having reported lower trade fair orders.

On the other hand, Li-Ning saw its first-half loss for 2014 soar to 586 million yuan and admits that its turnaround plan could take two more years before it can generate profits.

Meantime, Li-Ning said its revenue rose 8 percent year-on-year to 3.14 billion yuan, driven by higher sales of new products. "The clearance stage of the turnaround plan is almost complete, and the company is on its next stage of re-expansion," said Li-Ning interim chief executive Kim Jin-goon.

Kim attributed the company's losses to investment in retail and marketing, but he believes that, in time, they will bring in profits.

AMTD's Tang believes the country's rapid urbanization and the growing popularity of sports will further drive demand for affordable sportswear.

Ding holds the same opinion, noting that in the United States, people on average own four-and-a-half pairs of sports shoes, but people on the mainland only have half a shoe.

"Even though Chinese sportswear makers have taken care of the existing inventory issues, there are deeper problems to overcome such as changing consumer habits," said Tang.

He said this would leave mainland sportswear brands open to competition to international casual lifestyle brands like Zara and Uniqlo, which have established themselves in shopping malls in the country's top-tier cities.

He urged manufacturers to make a greater effort in building up their brands, including ensuring clear brand positioning and implementing effective marketing strategies.

"The mainland market is full of potential as most second- and third-tier markets are not fully explored, with some remaining untapped. But a lack of product differentiation has created intense competition among retailers in the race for market share," he said.

amandahua@chinadailyhk.com

(HK Edition 09/18/2014 page9)