Aging population fuels life insurance growth

Updated: 2014-11-28 07:13

By Gladdy Chu in Hong Kong(HK Edition)

|

|||||||

Fitch Ratings predicted a 14 percent growth for Hong Kong's life insurance sector in 2015.

The international credit rating agency said that it based its forecast on the increase in the aging population in Hong Kong and on the Chinese mainland. It also said it expected the rush to take out life insurance policies in Hong Kong by mainland people to continue.

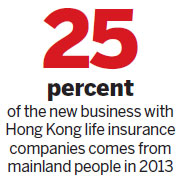

Mainland people accounted for about 25 percent of the new business of Hong Kong life insurance companies in 2013 and the percentage increased further to 28 percent in the first six months of 2014, Fitch said. In 2013, Hong Kong played host to more than 40 million tourists from the mainland.

"Thanks to growing links between Hong Kong and the mainland, we expect growth prospects (for the life insurance sector) to remain favorable in 2015," Terrence Wong, director of insurance at Fitch Ratings said. "Besides, an aging population and rising disposable personal income will also support the demand for medical and health insurance."

Castor Pang, head of research at Core Pacific-Yamaichi said that demand for Hong Kong life insurance products will be underlined by increase in mainlanders' spending power. Hong Kong is attractive to mainland policy holders because insurance payouts are free of tax, he said.

Many life insurers in Hong Kong have introduced a larger variety of yuan-denominated policies to lure mainland clients. Office of the Commissioner of Insurance's figures show that policies issued in yuan accounted more than 10 percent of new businesses for the sector in 2013.

Fitch said that Hong Kong life insurers usually have high reliance on mainland reinsurers to absorb the risks arising from their yuan-denominated liabilities.

"Yuan-denominated investment instruments for local life insurers are quite limited, prompting many of them to offload part of their yuan-denominated liabilities to insurance or reinsurance companies on the mainland," Wong said.

"The risk is mitigated since more (offshore) renminbi pools, such as those in London and Singapore, can provide viable options for insurers' investment," Pang said. "Also, they usually invest on the mainland via RQFII channel."

To non-life insurance sector, which is more dependent on the local economic environment, Fitch predicted 3 to 8 percent growth for 2015 against a backdrop of an economic slowdown.

Hong Kong's real economic growth slowed to 1.8 percent in the second quarter of this year. Gross direct premium of non-life insurance grew 2.1 percent in the first half of 2014, down from 6.9 percent a year earlier.

"We believe premium growth from construction and infrastructure projects will remain solid, offsetting the moderate decline in other business sectors such as employee compensation," he said.

Meanwhile, Fitch predicted that insurers will face higher compliance and administrative costs under the proposed new regulatory regime and small local insurers with limited asset size may find the financial burden too much to bear.

That, it said, could lead to increased merger and acquisition activities in the insurance sector in coming months.

gladdy@chinadailyhk.com

(HK Edition 11/28/2014 page8)