Robust growth for HK, mainland stocks: CLSA

Updated: 2014-12-16 05:59

By Gladdy Chu in Hong Kong(HK Edition)

|

|||||||

CLSA Ltd - the brokerage owned and managed by CITIC Securities - is bullish on the Hong Kong benchmark's performance next year despite its mixed views on the SAR and mainland property markets.

The brokerage said in a report on Monday it expects the Hang Seng Index (HSI) and the Hang Seng China Enterprises Index (HSCEI) to grow by 12 percent and 11 percent, respectively, to 26,500 and 12,300 in 2015.

The HSI dropped 0.95 percent to 23,027.85 at the close on Monday - about 15 percent lower than CLSA's target for next year.

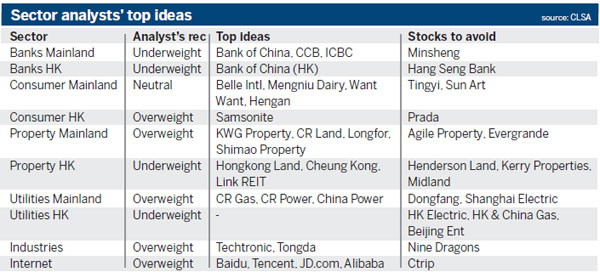

CLSA gave an overweight rating for the mainland's property market because of increased government support from local levels to the central level.

"With the central bank's easing of curbs on second home buyers on the mainland announced on Oct 1, some 40 percent of home buyers will, in theory, benefit from lower down payments and mortgage rates," Nicole Wong, regional head of property research at CLSA, said in the report.

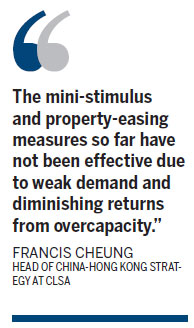

Francis Cheung, head of China-Hong Kong strategy at CLSA, said, however, the mini-stimulus and property-easing measures so far have not been effective due to weak demand and diminishing returns from overcapacity.

Since everything would not hinge on credit availability, such as whether cheaper and higher mortgage credit, will be available, Wong believed that the central government will move further to ease the market until it works.

On the other hand, CLSA gave an underweight rating for Hong Kong's property market because of growing supply and weakening demand, and suggested that investors reduce their exposure to the city's residential sector.

Cheung pointed out that the recent removal of the renminbi conversion limit for Hong Kong residents, along with the launch of the Shanghai-Hong Kong Stock Connect scheme on Nov 17, have created two risks for the local property market - the bank deposit and mortgage rates may go up if there's a Hong Kong dollar outflow, while the availability of new renminbi assets may reduce the appeal of Hong Kong property as home supply increases.

However, Adrienne Lui, an economist at Citigroup, forecast a stable local housing market for next year, saying she believed that an overall residential property price decline would be limited because of supply constraints and inactive turnover.

Citigroup property analyst Ken Yeung said: "As the user demand remains strong amid a mild interest-rate rising cycle, decent wages, a primary market shortage and low secondary market supply, mass market residential prices would climb by 8 percent year-on-year at the end of 2015."

Besides the property market, CLSA said the Internet sector in 2015 will benefit from accelerated 4G growth and online-to-offline migration. Out of 11 top stocks picks, three are from the Internet sector listed in the US, with Alibaba and Baidu ranking first and second, and JD.com ranking seventh.

CLSA chose other eight Hong Kong-listed stocks among its top stocks pick list. They are China Communications Construction Company from the infrastructure sector, insurance giant Ping An, Galaxy of the hotel-and-leisure sector, Great Wall Motor of the autos sector, Huadian Fuxin of the power sector, PCCW from the telecoms sector, Shenzhou International from the consumer sector and mainland real-estate giant Vanke.

gladdy@chinadailyhk.com

(HK Edition 12/16/2014 page8)