Yuan upsides fail to erase turbulence fears

Updated: 2014-12-16 05:59

By Oswald Chan(HK Edition)

|

|||||||

Economists and foreign exchange analysts are still confident of upsides for the Chinese currency but warn that trading volatility will increase next year. Oswald Chan reports.

The renminbi traded sharply weaker in mid-December, with both USD-CNY (offshore yuan) and USD-CNH (onshore yuan) breaking through 6.2 for the first time since July - as the mainland posted its slowest export growth in seven months.

CNH dropped to close at 6.1855 per US dollar in Shanghai on Dec 9, the weakest since July 29. Compared to Dec 31 last year, the CNH exchange rate slipped 2.2 percent at Dec 11.

However, economists and investment strategists reckon that the strong fundamentals of the mainland economy and the renminbi internationalization process can support a strong exchange rate in 2015.

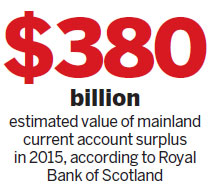

"We expect the CNY to appreciate mildly against the US dollar on the back of a large increase in current account surplus and the central government's need to internationalize the offshore yuan," Royal Bank of Scotland (RBS) chief China economist Louis Kuijs said.

According to RBS estimates, the mainland current account surplus will increase from $230 billion in 2014 to $380 billion in 2015, equal to 3.4 percent of the national gross domestic product.

This is based on expectations of reasonable export growth, subdued import growth and a significant improvement in the terms of trade in 2015.

RBS predicts a mild appreciation of the CNY against the US dollar in 2015 to just below 6, while HSBC forecasts the renminbi exchange rate to hover around 6.22.

Fan Cheuk-wan, chief investment officer at Credit Suisse Private Banking and Wealth Management Asia Pacific, expects the renminbi exchange rate to remain stable at the 6.12 level in 2015.

"The accelerating pace of yuan internationalization requires a stable yuan exchange rate," Fan said. "Moreover, overseas investment demand for yuan and the mainland's high current account surplus will support yuan foreign exchange rates."

Though upsides remain for the renminbi, the future exchange rate movement will be more volatile.

"It appears mainland (financial) authorities have remained hands-off in their forex policy. We believe (mainland) policymakers are allowing the currency to adjust more to market drivers than in the past," said HSBC Asian currency research head Paul Mackel.

"Moreover, the ongoing policy of capital account liberalization will only fuel structurally higher forex volatility for the yuan through 2015," Mackel noted.

"As importers have more demand to conduct outright forex hedging in the spot market to lock in their exchange rate costs, one-way appreciation expectations are unlikely to return to the renminbi market, thus pushing the renminbi to depreciate," he added.

Some other analysts are less bullish toward next year's renminbi exchange rates, citing the need for mainland authorities to cut interest rates to boost the sagging economy.

The People's Bank of China (PBOC) in a surprise move cut interest rates on Nov 22, in a bid to boost the slowing mainland economy and revive the declining inflation rate.

Government statistics show that the inflation rate in November slowed to 1.4 percent and economic growth moderated to a five-year low of 7.3 percent in the third quarter this year. The world's second-largest economy is expected to gain somewhat less than 7.5 percent in 2014.

ANZ Bank Greater China chief economist Liu Ligang said the drop in the mainland inflation rate to below the 2-percent level and the continued economic slowdown will induce the central bank to eventually adopt more accommodative monetary policies, including further interest-rate cuts and a lower reserve requirement ratio (RRR).

ANZ Bank predicts that the PBOC will cut the benchmark deposit rate by 0.25 percent in the upcoming first quarter and slash the RRR by 1.5 percent next year. The bank estimates that the mainland can only register 6.8-percent economic growth and a tepid inflation rate of 1.8 percent in 2015.

Besides the mainland economy factor, the relative strength of the US dollar also will affect the renminbi exchange rate.

RBS' Kuijs is worried that if the US dollar strengthens too much against other major currencies, it would ultimately lead to the depreciation of renminbi. "More pronounced the US dollar strengthening would heighten international financial turmoil. It may also shift the balance of consideration on the CNY and lead to some depreciation against the US dollar in 2015 rather than appreciation," Kuijs warned.

Contact the writer at oswald@chinadailyhk.com

(HK Edition 12/16/2014 page9)