Mainland lenders turn to certificates of deposit amid renminbi crunch

Updated: 2015-12-22 08:03

By Bloomberg in Hong Kong(HK Edition)

|

|||||||

Mainland banks from Hong Kong to London are selling a record amount of yuan-denominated certificates of deposit (CDs) as the mainland takes steps to curb outflows of the currency.

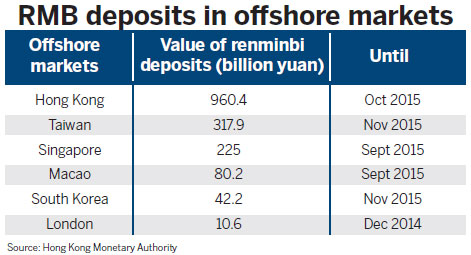

Sales jumped to an unprecedented 66.1 billion yuan ($10.2 billion) this month, data compiled by Bloomberg show. That comes after Hong Kong's pool of offshore yuan savings, the world's largest, shrank to the smallest in two years, and Deutsche Bank said the currency's depreciation pressures are weighing on deposits.

The central government has in the past month imposed restrictions on yuan outflows, including ordering a halt to offshore banks borrowing from domestic markets through bond repurchases, and suspending new applications in a program that allows domestic investors to buy overseas assets denominated in the currency. The measures are aimed at making it harder for speculators to short the yuan in the offshore market, according to National Australia Bank.

"The depreciation expectations have made it increasingly difficult for banks to get funds from the retail market. Coupled with higher interbank financing costs, commercial banks now have to turn to CDs to lock in stable and relatively long-term funding," said Becky Liu, Hong Kong-based senior rates strategist at Standard Chartered.

China has scaled back efforts to prop up the yuan after the International Monetary Fund included the currency in its Special Drawing Rights on Nov 30. The yuan traded in Hong Kong has retreated 2.1 percent since then to 6.5637 a US dollar on Friday and is set for the biggest monthly loss since August. Savings in the mainland currency in Hong Kong fell 15 percent this year to 854 billion yuan in October, according to latest available data, prompting lenders, including Bank of China (Hong Kong) to offer higher interest rates to attract savers.

In December, Agricultural Bank of China's unit sold 63 million yuan of six-month certificates of deposit in Hong Kong, while China Construction Bank's London subsidiary issued 100 million yuan of three-month securities.

"CDs can help banks raise a lot of money in a relatively short period of time," said Jack Yang, head of the yuan business division at Bank of China (Hong Kong). "Compared with selling yuan bonds offshore or attracting deposits from the retail market, it will continue to be the preferred way to raise funds for offshore mainland lenders."

(HK Edition 12/22/2015 page8)