Minority shareholders need to be protected

Updated: 2016-08-31 07:53

By Peter Liang(HK Edition)

|

|||||||

Reports of Singapore allowing dual share listing on its stock exchange have brought to life an issue that most of us thought had been long buried in Hong Kong.

Neither the Hong Kong stock exchange, which supports dual share listing, nor the watchdog agency, the Securities and Futures Commission (SFC), which opposes it, has commented on the Lion City's latest move. But insiders have said they expect some stock exchange members to cite Singapore's threat to pressure the local bourse and regulatory authorities to review the controversial idea.

The issue was brought to the forefront a few years back when Chinese mainland e-commerce giant Alibaba sought to secure a listing in Hong Kong. But, the proposed transaction fell through after the SFC made known its objection to amending the Securities Ordinance to accommodate Alibaba's request for a dual share listing. Alibaba later secured a listing on the New York stock exchange.

Hong Kong's seemingly uncompromising position on Alibaba's case was seen by many stock brokers and investment bankers as an opportunity lost. They contended that banning dual share listing has made it difficult, if not impossible, for the city to attract IPOs (initial public offerings) of many mainland tech companies, whose owners need to raise new capital but want to retain full control of their enterprises.

The SFC reiterated its stand against dual share listing when the stock exchange proposed public discussions on the issue. The plan was later withdrawn.

Hong Kong incorporated the ban on dual share listing into the Securities Ordinance to provide an added layer of protection of the rights of minority shareholders. Dual share listing is inherently unfair to minority shareholders and is open to abuse by controlling shareholders. Additional safeguards against potential abuses would greatly increase the costs and workload of the SFC. It's just not worth the trouble.

In addition, the prohibition of class action lawsuits in Hong Kong has made it prohibitively costly and troublesome for minority shareholders themselves to seek redress and compensation from companies in cases of abuse.

Investors who are keen on buying mainland tech companies' shares should be able to do so through the Shenzhen-Hong Kong Stock Connect which is expected to come into play later this year.

|

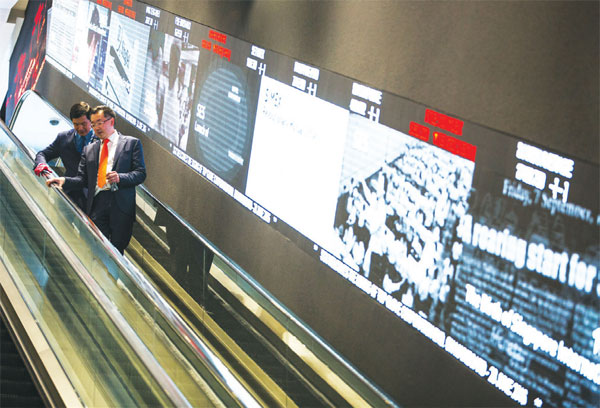

The Singapore Stock Exchange - a key competitor in the region's financial race. A reported plan by the Lion City's bourse to introduce a dual share listing system has raised eyebrows in Hong Kong. Industry experts say they expect the Hong Kong bourse and securities watchdog to reignite debate on the contentious issue that has long been swept under the carpet. Nicky Loh / Bloomberg |

(HK Edition 08/31/2016 page9)