China Evergrande in bold backdoor move

Updated: 2016-10-05 07:22

By Lin Wenjie in Hong Kong(HK Edition)

|

|||||||

Mainland property giant to inject core property assets into Shenzhen-listed company in bid for higher valuation

Chinese mainland property conglomerate China Evergrande Group plans to pump a substantial chunk of its core assets into a Shenzhen-listed company in a purported bid to secure a higher valuation through a backdoor listing.

The move by the Hong Kong-listed, debt-saddled group - the country's second-largest developer by sales - has raised eyebrows among market pundits who expressed skepticism over whether the deal can ultimately get the green light from the authorities.

The deal is still subject to approval by shareholders, as well as regulators in Hong Kong and on the mainland, where moves are afoot to tighten procedures for backdoor listings - which have grown popular with companies that have failed to meet the criteria for a flotation.

Despite the uncertainties surrounding Evergrande's move, its H shares staged a spectacular performance in Hong Kong on Tuesday morning, surging as much as 12 percent when trading resumed a day after it was suspended. It was the stock's biggest gain since July last year.

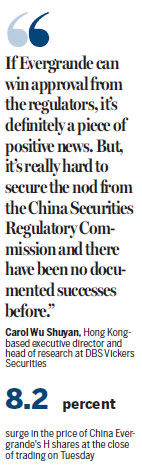

Guangzhou-based Evergrande's stock still chalked up a gain of 8.2 percent to close HK$5.67, while the benchmark Hang Seng Index climbed 0.45 percent to 23,689.44 points.

According to a filing with the Hong Kong Stock Exchange on Monday, Evergrande-owned Guangzhou Kailong Real Estate will sell 100 percent of its equity interest in Hengda Real Estate to the Shenzhen government's Shenzhen Real Estate, which would result in Kailong Real Estate becoming the controlling shareholder of Shenzhen Real Estate.

The transaction would be paid in stock and cash. Shenzhen Real Estate, which is said to be worth about 200 billion yuan ($30 billion), has agreed that, prior to the signing of the definitive agreement, Hengda Real Estate may introduce strategic investment of up to 30 billion yuan.

"The proposed reorganization will enable the market to assess the intrinsic value of the company positively and reasonably, as well as providing an additional fundraising platform for the company," Evergrande said in the filling.

"If Evergrande can win approval from the regulators, it's definitely a piece of positive news. But, it's really hard to secure the nod from the China Securities Regulatory Commission (CSRC) and there have been no documented successes before," said Carol Wu Shuyan, Hong Kong-based executive director and head of research at DBS Vickers Securities.

A case in point involved Shenzhen-based Logan Property. The Hong Kong-listed company had intended to transfer at least 30 percent of its voting rights to Shanghai-listed, State-owned motorcycle manufacturer China Jialing in exchange for control of Jialing, as a way to secure a backdoor listing on the A-share market. But, the restructuring plan was scrapped in July this year due to concern over whether it could ultimately win regulatory approval.

"However, there's one point I would like to make. The to-be-acquired Shenzhen Real Estate is a company under the Shenzhen government, which may thus facilitate the transaction getting approval. If Evergrande succeeds in securing a backdoor listing in Shenzhen, other Hong Kong-listed mainland developers would definitely do likewise," Wu added.

RHB analyst Toni Ho said that, given the tightened procedures for backdoor listings, a CSRC nod seems to be a distant dream. Besides, RHB believes that Evergrande will keep its listing in Hong Kong, given its "huge" offshore borrowings.

Evergrande has attracted market attention after having amassed about $57 billion in debt - almost six times its market value - through land acquisitions and corporate mergers, according to a Reuters report.

"The proposed reorganization to backdoor list Evergrande's businesses in A shares is 'overall positive' if it goes through," Citi analyst Oscar Choi said on Monday.

"Mainland investors may price Evergrande's assets at a higher valuation and the deal would provide a new onshore platform for financing," he said.

cherrylin@chinadailyhk.com

|

China Evergrande Group's property portfolio spreads far and wide across the country, including this residential project in Hubei province. The debt-saddled developer's H shares posted the biggest gains since July 2015 after it announced plans to inject core property assets into a Shenzhen-listed firm to seek a backdoor listing on the A-share market. The deal is subject to approval by shareholders and regulators. Provided to China Daily |

(HK Edition 10/05/2016 page5)