'Hot money' set to lift HK's office, industrial sector

Updated: 2016-11-16 09:31

By oswald chan in Hong Kong(HK Edition)

|

|||||||

SAR warned against deterring southward investors with high stamp duty

The continued inflow of funds from the Chinese mainland will play a crucial role in boosting investments in Hong Kong's office-and-industrial sector, but the government should not levy exorbitant stamp duty at this stage to fend off mainland investors as it did for the residential sector, real estate analysts reckon.

The SAR's surprise announcement earlier this month to impose a 15-percent stamp duty on all residential homes purchases, except for first-time homes buyers who are permanent residents, is expected to put a stopper on soaring property prices in the world's most unaffordable market.

"Hong Kong's higher stamp duties may damp investment demand for residential units, while interest in non-residential properties may improve. Some investors may shift to buying offices and parking spaces, which are not subject to the new 15-percent duty," predicted Patrick Wong, senior real estate analyst at Bloomberg Intelligence.

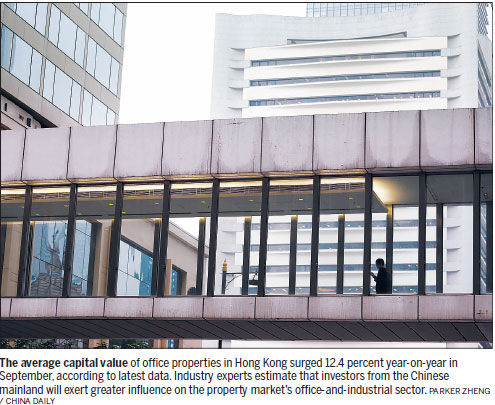

The average capital value of office properties in Hong Kong surged 12.4 percent year-on-year in September, according to Colliers International data.

"Purchases and sales of commercial buildings had soared to an average 120 cases per month in the third quarter of this year, whereas some high value ticket sales and sales of en-bloc buildings are conducted by mainland investors," Ricacorp Properties' Head of Research Derek Chan Hoi-chiu told China Daily.

"However, I reckon that the administration, at this stage, should not levy any exorbitant stamp duty to curb office and industrial building transactions because this market segment is not as buoyant as the residential sector," he said.

Wheelock and Co Ltd has sold both towers of its One HarbourGate complex in Hung Hom to mainland investors, with mainland insurance giant China Life Insurance (Overseas) Co Ltd acquiring the West Tower for HK$5.8 billion late last year. Shenzhen-based Cheung Kei Group, controlled by billionaire Chen Hongtian, snapped up the East Tower for HK$4.5 billion in July this year.

"Some purchases of office assets by mainland institutional investors are not based on rational investment analysis. They just want to snatch every available office asset in Hong Kong because there aren't much available for sale in the market," noted So Kwok-kei, Asia Pacific real estate tax leader at PricewaterhouseCoopers Hong Kong.

Looking ahead, if the US delays interest-rate hikes due to macroeconomic uncertainties arising from Donald Trump's upset win in the presidential election, this should bode well for Hong Kong's property assets.

"This prospect has positive implications for property assets in Hong Kong because local interest rates are effectively tied to US rates as a result of the city's currency peg," explained Andrew Haskins, research executive director at Colliers International.

"We do not expect Hong Kong to return to positive real interest rates as before early 2018 and, possibly, the second half of 2018. This outcome should support capital values across most segments of the local property market," Haskins said.

oswald@chinadailyhk.com

(HK Edition 11/16/2016 page7)