-

News >Bizchina

Pricing issues queer the pitch for steelmakers

2010-03-25 09:48

Workers sweep iron ore dust at Qingdao Port, Shandong province. Iron ore imports saw an increase of 41.6 percent in 2009 compared with 2008.[China Daily]

BEIJING: The existing differential pricing system for iron ore imports needs to be dismantled as it fosters corruption and triggers woes for the steel sector, leading industry experts said on Wednesday.The comments come against the backdrop of the ongoing benchmark iron ore negotiations and the trial in Shanghai of four Rio Tinto employees for accepting bribes.

"The long-term and spot pricing systems are ideal breeding grounds for corruption," said Xu Xiangchun, chief analyst at consulting firm Mysteel.com.

Lending credence to the statement are the charges against the four Rio employees. They have been accused of accepting bribes from small- and medium-sized Chinese steel mills for iron ore supplies at contract prices.

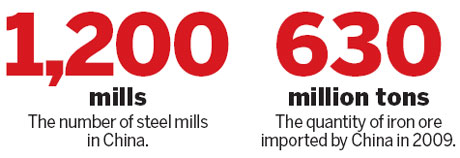

There are 1,200 steel mills in China. But only 112 steel mills and 40 trading firms have licenses to import iron ore at long-term prices. And therein lies the genesis of all the problems.

Small- and medium-sized mills that do not have licenses are forced to buy iron ore from the spot markets or sign individual contracts with global miners privately.

But with ore prices skyrocketing, many mills would rather prefer to negotiate private deals for ore supplies at contract prices rather than procure supplies from spot markets, Xu said.

There is also a huge demand-supply gap for iron ore in China. "When supply is less than demand, the suppliers will have more power to fix prices and also decide on whom the supplies should go to," said Xu.

Spot prices of 62 percent iron ore have risen to over $130 per ton including freight since February, more than double the benchmark prices of 2009, largely due to the surging demand from China.

Steel demand is expected to go up by 8 to 10 percent this year, said Zhu Jimin, chairman of Shougang Group at the Asia Mining Congress in Singapore on Wednesday. The Beijing-based company is the seventh biggest steelmaker in China by output.The nation's $586 billion stimulus package has significantly boosted steel demand especially from automobile firms, home-appliance manufacturers and builders.

China imported 630 million tons of iron ore in 2009, up 41.6 percent from 2008, according to official data.

The steel lobby, China Iron and Steel Association (CISA), has for long strived for a unified iron ore price for all imports to regulate the market, and to erase the differences between long-term and spot prices.

Under the suggested plan, agents can levy a commission of 3 to 5 percent on the total iron ore import charges collected.

Luo Bingsheng, vice-president of CISA, reiterated last month that promoting the agent system at a unified price for iron ore will be the primary target for CISA this year, and the association has already won support from the government.

Hu Kai, an analyst at Umetal, a steel consulting firm, said such measures alone couldn't solve the problems fundementally.

China needs to control steel output, enhance exploration of domestic mines and increase investment in overseas mining resources, said Hu.