-

News >Bizchina

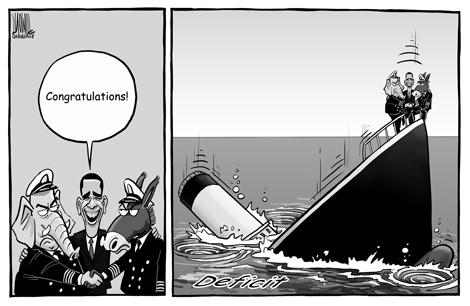

Dollar depreciation dilemma

2011-08-02 15:16China should expand the scale of its sovereign wealth funds to protect its growing foreign exchange reserve

Its $3.2 trillion foreign reserve means China is sitting on a volcano. How to manage its ever-expanding national wealth and prevent its national economic and financial security from being endangered by the still-fermenting debt risks in the United States and Europe poses a severe challenge to the country.

Up until 1995, developed countries still controlled the majority of global foreign reserves, while developing countries were plagued by the insufficiency of their foreign reserves. Since then the situation has substantially changed as foreign reserves held by emerging economies have dramatically increased and their proportion of the world's total reserves has continuously kept rising.

China's foreign reserve is now nearly 30 percent of the world's total. Russia holds nearly 7 percent of global foreign reserves and other emerging economies, such as India and the Republic of Korea each possess nearly 4 percent. Currently, foreign reserves held by emerging economies amount to more than 50 percent of world's total.

Despite the declining proportion of US dollar-denominated foreign assets in global foreign reserves over the past decade, down from 71 percent in 1999 to 61 percent in 2010, according to the IMF, the dollar is still overwhelmingly bigger than the euro, the pound and the Japanese yen in the currency composition of global foreign exchanges reserves. This dollar-biased composition has, with the 13 percent depreciation in the dollar since the start of the global financial crisis, directly resulted in the dwindling of the dollar-denominated foreign reserves held by emerging economies.

Despite their efforts to diversify the composition of their foreign reserves, emerging countries have so far failed to find effective ways out of their current dilemma owing to the similar devaluation of the euro, the pound and the Japanese yen.

In a move to keep the value of their foreign reserves and improve their ratio of return, an increasing number of countries have set up sovereign wealth funds in recent years, especially since the onset of the global financial crisis. So far, nearly 30 countries or regions have established sovereign wealth funds and the total assets at their disposal amounted to $3.98 trillion in early 2011.

Compared to its mammoth official foreign reserve, China has made much slower progress than many countries in the expansion of its sovereign wealth funds, especially in its stock investments. Currently, China has only three main sovereign wealth funds: One with assets of $347.1 billion is managed by the Hong Kong-based SAFE Investment Co Ltd; the second, with assets of $288.8 billion, is managed by the China Investment Corporation, a wholly State-owned enterprise engaging in foreign assets investment; the third fund of $146.5 billion is managed by the National Social Security Fund.

From the perspective of its investment structure, China's sovereign wealth funds have long attached excessive importance to mobility and security. For example, the China Investment Corporation has invested 87.4 percent of its funds in cash assets and only 3.2 percent in stocks, in sharp contrast to the global average of 45 percent in stock investments.

China should further expand the scale of its sovereign wealth funds and strive to switch from financial investment to industrial investment in a bid to accelerate its overseas mergers and the acquisition of overseas resources, as well as the expansion of its stock ownership in some new industries overseas.

The country can also use part of its foreign reserve to set up a foreign exchange stabilization fund as a move to moderately intervene in its foreign exchange market and prevent the rapid appreciation and depreciation of the yuan against foreign currencies.

With such a stabilization fund in place, China's monetary authorities can separate its monetary policy from the exchange rate policy, a move than would help maintain the flexibility and independence of the country's monetary policies. The country's increased issuance of base currency as the result of the rapid increase of its foreign reserve has caused the flooding of liquidity and turned out to be an important source of its growing inflation pressures. At the same time, the issuance of central bank bonds as a way to hedge against the rapid rises in the country's funds outstanding for foreign exchange since April 2003 has caused China's central bank to pay nearly 1 trillion yuan in interest.

China should also try to change its official foreign reserve structure in a bid to transfer its national wealth from the government to the people. To facilitate this process, it should try to set up a well-developed foreign exchange mechanism, expand its foreign exchange investment channels and suspend long-established restrictions on enterprises and individuals' overseas investment.

The author is an economics researcher with the State Information Center.