Fifth FDI fall amid EU woes

Investment focus to highlight western and central regions

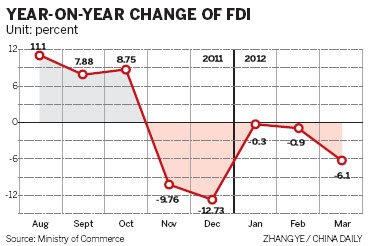

Foreign direct investment fell for a fifth straight month in March as the European debt crisis worsened and the world's second-largest economy registered weaker growth.

The Ministry of Commerce said the FDI outlook remains "grim" in the coming months. However, measures will be taken to "stabilize" FDI by encouraging foreign companies to invest in central and western regions.

China's inbound investment last month dropped 6.1 percent, from a year earlier, to $11.76 billion, the ministry said on Tuesday.

The February figure was a 0.9 percent drop.

"Foreign companies invest less in a sluggish global economy," Shen Danyang, the ministry spokesman, said.

"Tightening policies on the property market also led to a decrease in foreign investment," he said.

Real estate makes up about 25 percent of FDI and foreign investment from the sector dropped by 6.3 percent year-on-year, in the first quarter.

The corresponding period last year saw a gain of 38.6 percent.

Investment from the European Union, grappling with a major sovereign debt crisis, tumbled 31.2 percent in the first quarter, from a year earlier, to $1.41 billion. Europe is a key trading partner and its economic troubles have had consequences for China as witnessed by the Friday announcement that the economy grew at the slowest pace in almost three years.

However, Tuesday's figures showed capital flow from the United States rose 10.1 percent, in the first quarter, to reach $893 million. This reversed a falling trend over the last few months as the world's largest economy shows signs of recovery.

From January to March, China's FDI fell by 2.8 percent from a year earlier to $29.48 billion, the ministry said. This is in contrast to a 29.4 percent increase during the same period last year.

"Rising labor costs are also making China less attractive for foreign investors," Shen said.

But falling FDI may be a short-term scenario as foreign companies eyeing the consumer market will invest, said Wang Zhile, director of the research center of transnational corporation, at the Chinese Academy of International Trade and Economic Cooperation, a think tank affiliated to the ministry.

"I am rather optimistic about FDI in the long term."

Frederic Neumann, managing director of Asian Economic Research at the Hongkong and Shanghai Banking Corp, agreed.

"Many international companies are looking at other investment destinations, such as Southeast Asia, to take advantage of cheaper labor. But this doesn't mean that China is not an attractive investment destination. In fact, we still sense a lot of interest by capital market investors taking more exposure to China," Neumann said.

Wang Chao, deputy minister of commerce, said recently that FDI could be "sustained" thanks to the country's stable economic growth and improving business sentiment.

Samsonite International, the world's biggest luggage maker, said recently that it plans to add 25 more stores this year, on top of the 60 on the Chinese mainland, to tap growing demand.

Moving inland

Efforts will be enhanced to guide foreign companies in investing in central and western regions.

Foreign capital into the eastern region dropped, in the first quarter, by 3.66 percent, but FDI into central areas grew by 20.72 percent, the ministry said.

Samsung Electronics, Asia's largest consumer-electronics provider, announced, in early April, a $7-billion investment in Xi'an, Shaanxi province, to make a memory chip widely used in smart phones and tablet computers. This is the largest foreign investment the western region has ever absorbed.

Contact the writers at dingqingfen@chinadaily.com.cn and chenlimin@chinadaily.com.cn