Study: Overseas property ventures expected to enjoy robust growth

Investment from China in overseas property markets is expected to grow by 20 percent annually on average through 2020, when it will stand at about $50 billion per year, as market-oriented reforms encourage companies to explore opportunities abroad.

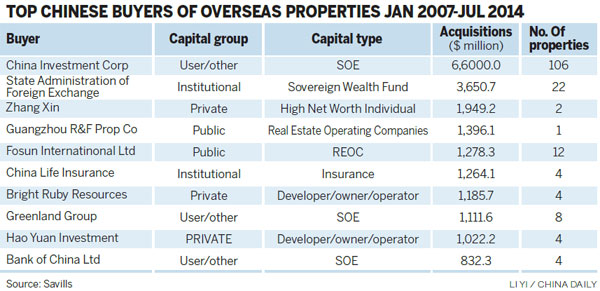

The figure is comparable to what United States-based investors have put into overseas real estate markets over the past few years, according to Savills Plc, an international real estate adviser.

Chinese institutions invested close to $13.5 billion in overseas real estate markets last year, more than double the figure in 2012.

Reforms in China are expected to trigger new waves of investment from China in the next decade, Savills said.

About $11.3 billion worth of confirmed transactions were booked in the first 11 months of this year.

About $2 billion of pending deals may emerge before the end of the year.

Chinese cross-border real estate investment is expected to surpass $30 billion this year, more than the total such investment in the past few years combined, said Han Changji of market research firm CI Consulting.

Chinese companies and investors stepped up their pace of overseas property investment this year and last, Han said.

He cited domestic forces such as falling residential property transactions, increasing vacancy rates, declining prices in third- and fourth-tier cities and higher risks.

The nation's property market has grown by leaps and bounds over the last two decades but the competition has increased and the scope for further rapid growth has become more limited, said Savills.

Companies, developers and investors have increasingly turned overseas to maintain growth.

For large companies, it is important to diversify portfolios to mitigate risks and smooth out cycles.

Companies can also benefit from overseas exposure by learning how other markets work and bringing that knowledge back to the domestic market.

And by building their brand images overseas, they can have easier access to the international capital markets.

The once-in-a-generation revaluing of real estate assets in North America and Europe, and the strength of the yuan, have also generated significant value propositions for Chinese investors.

The top destinations for Chinese real estate investment from 2010 to 2013 were the United States, Australia, Singapore, Luxemburg and the United Kingdom.

As Chinese investors become more confident, they tend to venture further from home.

Last year and this year, they turned primarily to the US, UK and Australia in search of higher-yielding assets.

While Asia-Pacific opportunities continued to play a significant role in overseas strategies, the weighting of Asia-Pacific deals declined from 54.2 percent in 2012 to 21 per cent in the first 11 months of this year.

Among Chinese companies, developers are making the largest push overseas.

As their confidence continues to grow, they will develop more mature overseas teams and strategies with stronger ties with international counterparts.

They are likely to invest a larger share of their portfolio into overseas markets.

As overseas investment expertise and experience filters down into small and medium-sized developers, these businesses are also expected to explore opportunities in international markets, the report said.

liwenfang@chinadaily.com.cn