Loan scheme helps Tibet's small businesses grow

Credit rating policy rolled out by Agricultural Bank of China has allowed farmers to expand their operations and increase annual incomes

Jampa Norbu lives in a village in Lhunzhub county, which is 60 kilometers away from Lhasa, the capital of the Tibet autonomous region. He has a family of seven, 8.24 acres of land and nine cattle. Most of the family's income comes from farming highland barley and wheat.

In 2011, he took out a three-year loan of 30,000 yuan ($4,830) from the Agricultural Bank of China Ltd to buy farm machinery. Ever since, his income has increased 20 percent annually on average to 60,000 yuan.

After he paid it off last year, he applied for another loan of up to 200,000 yuan. Jampa Norbu hopes to use the money to buy 15 more cows and build a cattle farm along with three poverty-stricken families, who will work with him.

"I expect to recover the investment in two years by selling more than 9.7 liters of milk a day as well as breeding calves," he said. "The government also gives us fodder subsidies of more than 1,000 yuan per cow per year."

Back in 2003, the Agricultural Bank of China Ltd, the nation's fourth-largest lender by assets, introduced a "character loan" service in Tibet.

Local bank officials visit each family in the region and conduct a simple survey. This involves their financial situation, their reputation and business prospects.

With the help of the village chief and township government, the bank rates each household's credit at different levels.

The families that are granted a top-level "diamond card" can apply for loans of up to 200,000 yuan, at the poverty alleviation rate of 1.08 percent, without putting up collateral. Those families receiving the lowest-level "bronze card" are allowed to borrow no more than 20,000 yuan.

"Before the bank introduced the 'character loan' service to Tibet, it was hard for many farmers in this region to receive bank loans because they lacked sufficient collateral," He Qin, head of Lhunzhub county sub-branch of Agricultural Bank, said.

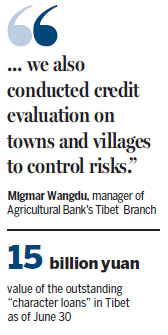

Obviously, some of the loans borrowed by farmers and herders are often small, just 1,000 yuan, according to Migmar Wangdu, manager of Agricultural Bank's Tibet branch.

"This makes it cost-ineffective for the bank to conduct pre-loan investigations and post-loan reviews for each one," he said.

Twelve years after it was launched, 95 percent of the families in Tibet have a "character loan" card. As of June 30, the outstanding character loans in the region were more than 15 billion yuan.

They have been used to expand tourism services, buy machinery and even finance construction projects. The nonperforming loan ratio of Agricultural Bank's Tibet branch was only 0.49 percent by the end of May.

"Apart from assessing the credit of each family, we also conducted credit evaluation on towns and villages to control risks by encouraging timely loan repayments," Migmar Wangdu said.

"The residents in those towns and villages that do not have nonperforming loans will see their credit rating rise."

A large number of residents have developed their own businesses and increased their family incomes with the support of Agricultural Bank. Last year, the annual income per capita in Lhunzhub county jumped to more than 6,000 yuan, up 1,700 yuan from 2013.

As a driver for the local commission for politics and law in Kyurong village, Lhundrub county, Solang Norbu used to make 4,000 yuan a month. The 44-year-old borrowed 150,000 yuan from Agricultural Bank in 2012 through the "character loan" program.

He then founded a cooperative along with 19 other families to raise 220 Tibetan chickens.

Each Tibetan chicken egg, which is believed to be more nutritious than those from other birds, is sold for 3 yuan. The price is much higher, compared with 0.8 yuan for an egg in Beijing. The cooperative made a net profit of 30,000 yuan last year.

Now, Solang Norbu has paid off two-thirds of the loan and has applied for another one. He hopes to borrow 400,000 yuan to expand the business, using his salary as collateral.

His plan is to buy an incubator that can hatch 2,200 eggs. This will increase his chicken population, which will help the operation to grow.

"I hope to sell Tibetan eggs to inland cities like Beijing," he said.

|

Bank clerks on their way to Ngari prefecture in the Tibet autonomous region to visit clients on horseback. They travel to agree loans or collect repayments no matter what the weather is like. The region is 4,500 meters above sea level. Provided To China Daily |