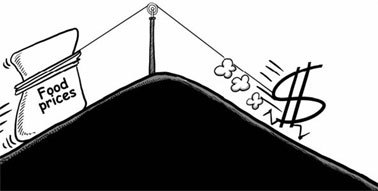

Rising food prices, weak dollar hit poor

By Larry Elliott (China Daily)

Updated: 2008-04-25 07:27

Updated: 2008-04-25 07:27

Against the backdrop of the gloomiest outlook for the global economy in many years, the price of oil was closer to $120 a barrel for the first time last week and the cost of wheat, rice and soya beans soared.

The first rule of economics - that prices are determined by demand and supply - appears to have broken down. When times are tough, commodity prices normally fall, but as the financial crisis has deepened over the past nine months they have been going up and up.

There are several explanations for this strange phenomenon. One is that markets are indeed still reflecting demand and supply, since the short-term effects of a looming recession are being outweighed by longer-term threats to supply.

On this basis, the rise in food prices has been caused by the drive for biofuels, while higher oil prices reflect the unpalatable truth that the world may have reached the point where it is going to start running out of crude.

Similarly, turning land used for food over to crops for biofuels may have something to do with the 120 percent increase in the cost of wheat and the 75 percent rise in the price of rice over the past year. But, again, it is not the whole story.

That "something else" is the precipitous decline in the value of the US dollar.

Take a look at the accompanying charts, which show very strong correlations between commodity prices and the exchange rate for the greenback.

According to Nick Parsons, head of strategy at nabCapital, every time the dollar has weakened, hedge funds have bought commodities. The reason hedge funds act in this way is that commodities are priced in dollars and so when the US currency is falling, producers outside America raise prices to compensate.

A more likely cause of the speculation, however, is that the hedge funds base their decisions on economic models that reflect the correlations displayed in the charts on this page. When the dollar falls, the models guide them to buy commodities, and the subsequent wave of buying pushes up the prices.

Now take another look at the graphs that chart the relationship between the oil price and the exchange rate between the dollar and the euro. The upward trend in the cost of crude is unmistakable, yet oil prices have fallen back every time there has been a modest dollar rally.

The chart would suggest that a recovery in the dollar to $1.35 against the euro would bring oil prices back down to $70 a barrel.

Food prices would also come down, and while that does not represent a panacea for the problems of agriculture in poor countries, in the short-term it would mean fewer people going hungry this year. At $1.35, the price of rice would be about 10 cents per hundredweight as opposed to almost 25 cents today.

There is little to suggest that the dollar is going to strengthen, with the markets expecting further cuts in US interest rates and borrowing costs in the euro zone to remain steady.

American policymakers seem quite content to let the dollar fall, since a depreciating currency makes exports cheaper and the European Central Bank sees a rising euro as a bulwark against the inflationary pressures caused by higher commodity prices, since a stronger currency makes imports cheaper.

This is a strange sort of logic. While it's true that exports are the one bright spot for the US economy, a key reason for that is that American consumers are paying far more for their fuel and food.

If a stronger dollar meant oil prices at $70 a barrel rather than $115 a barrel there would be a sizeable boost to the domestic economy. Similarly, the ECB appears to be putting the cart before the horse. If a weaker euro meant weaker commodity prices, there would be less of an inflationary threat to worry about.

In the circumstances, it is curious that the G7 countries are not talking more seriously about coordinated intervention to reverse part of the dollar's decline.

At its meeting in Washington earlier this month, the G7 toughened up its language on currencies, expressing concern about the possible implications for economic and financial stability of recent sharp fluctuations.

The question, therefore, is why the G7 is not prepared to turn words into action. One answer could be that central banks believe intervention doesn't work. It is certainly true that there are occasions when it doesn't, but the last time there was coordinated action by the G7 - the September 2000 support operation for the euro - it was a spectacular success.

A second argument is that the weakness of the dollar is necessary to eliminate the global imbalances - the hefty US trade deficit and the massive surpluses run by Asian exporting nations. Yet the exchange rate has probably already achieved maximum impact on the US trade deficit: to eliminate the imbalances solely by depreciation would require a further colossal - and wholly unrealistic - fall in the value of the dollar.

Finally, it is said that intervention is pointless in the current climate because it goes against the grain of monetary policy, and with rates in the US likely to reach 1 percent this summer and the ECB with a bias to push them up from 4 percent it would be throwing good money after bad. But it might not be.

Imagine that intervention was sudden, large scale and carried real intent. In those circumstances, the dollar bears would be wiped out and commodity prices would fall sharply.

Rising real incomes in the US and a less pronounced threat to inflation in Europe would change the market view of interest rates: there would be less pressure for cuts in the US, less pressure for increases in Europe.

Intervention, in other words, might bring about a closer alignment of monetary policy that would justify the intervention. For this to happen, though, there needs to be a leap of faith. Until we get it, the headwinds facing the developed world will grow stronger. And the poor will get hungrier - and angrier.

The Guardian

(China Daily 04/25/2008 page9)

|

|

|

|