Op-Ed Contributors

Paving the way for inheritance tax

By Yang Zhiyong (China Daily)

Updated: 2010-09-14 08:02

|

Large Medium Small |

Chen Guangbiao is among the few philanthropists in China to pledge his entire fortune to charity after his death. But most of the rich Chinese have till now kept away from the charity campaign of Bill Gates and Warren Buffett, which will culminate at the end of this month.

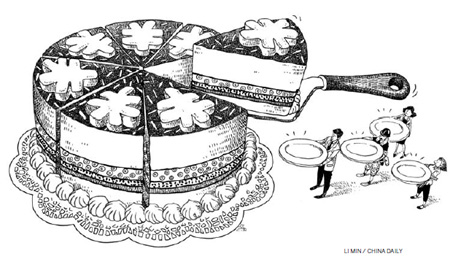

Inheritance tax is necessary to promote social equality in the long run, but the existing taxation system has not played the role it should have in narrowing the wealth gap in society.

China is in the middle of a socio-economic transition, and there are many reasons for the serious inequality in income distribution at the primary level. Although taxation can help adjust income distribution to some extent, it would be childish to assume that it alone could facilitate social justice. What people seem to despise is not the wealth amassed by the rich but the illegal means through which some nouveaux riches have accumulated it.

Since rational income redistribution is essential for maintaining social stability in China, the government has to have a clear objective and method of income distribution reform. It should not take it for granted that people with higher income would provide the funds to offset the low income of the poor.

In market economy, any subsidy that higher-income people offer to the poor should be treated as reparation for market inefficiencies. The government should use the tax collected from the rich to help the lower-income group meet its needs and improve their life. The government can probably choose different objectives of social justice for imposing tax on the rich at different stages of social development.

But would such an arrangement still motivate people to make that extra effort to earn more on their own and improve their livelihood? If society simply finances the poor with the money obtained from the rich, people could be discouraged from making money on their own, and eventually the entire economy will lose the growth momentum. In such a case, society will be found lacking in resources for redistribution. That is to say, an improper redistribution policy can deteriorate income distribution further.

Before imposing inheritance tax on the rich, the government must study international taxation laws and practices thoroughly. What happens if some countries do not impose inheritance tax at all or have much lower rates and China decides to implement it hastily? It could cause many rich Chinese to migrate abroad and lead to unnecessary outflow of domestic capital, harming the national tax revenue and even the national economy.

A practical solution for China would be to reform the primary national distribution system gradually to strike a balance between efficiency and fairness. The government has to lower the income level of monopoly industries by building promising model mechanisms and encouraging competition.

It should adjust the compensation system, which uses State-owned resources, to reduce the high income of vested interest groups, and invest the resources at its disposal in public services. Since China has chosen to travel the road of market economy, the government should give full play to the market in allocating resources.

To adjust the national income distribution structure, the government should take measures, such as reducing enterprises' savings and increasing the overall income level of the common people, to ensure more people enjoy the fruits of economic growth. It should also take steps to transfer surplus labor from the rural areas to industries to narrow the gap between cities and villages.

Urbanization and industrialization are a good choice for developing countries such as China to increase the incomes of the needy. For this, the government should abolish the outdated household registration system (hukou) as soon as possible, for it will give people the freedom to move in and out of rural areas and cities. The government should take steps to boost trans-regional transfer of labor, too, to bridge the income gaps in different regions.

As far as inheritance tax is concerned, the country still doesn't have the basic conditions and machinery to collect it. The tax department has limited information about people's true income. So, how can they be sure about the a person inherits? Jumping the gun to collect inheritance tax may not promote social justice. Instead, it could make income distribution more unfair.

The government has to reform the comprehensive and individual income tax institutions before imposing inheritance tax. It should start taxation reform by improving tax collection and management, and plugging the existing loopholes in the system. For example, it could pass an anti-money laundering law to decrease cash transactions.

Another important thing for the government to do is to build an exchange network for different functional authorities to help tax departments know the real income of taxpayers' potential inheritance. To ensure no rich person avoids paying his/her taxes properly, tax collectors could introduce lowest replacement taxation. For example, they can make the capital scale the basis of personal income tax collection from the rich.

Moreover, government should realize effective management and proper collection of personal income tax can help build a mature institutional environment for collecting inheritance tax.

The author is a research scholar with the Institute of Finance and Trade Economics, Chinese Academy of Social Sciences.