All eyes are on Europe right now. Even in Asia, which so far is blissfully removed from the financial jitters in the West, apprehension is growing. That's understandable: the region can withstand a mild, cyclical downswing in Europe and the United States, but, as 2008 showed, not outright financial calamity.

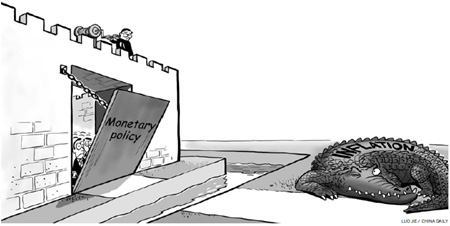

That's not on the cards just yet, but the memories of the global financial crisis clearly run deep. Pressure is thus rising on local central banks to cut rates and pre-empt a potentially sharper downturn in Asian growth. That would be a mistake.

No doubt, aggressive rate cuts in 2008, in China as elsewhere, helped spur an impressive rebound. Asia's industrial output, partly as a result, is more than one-third higher now than it was at the beginning of that slump. So it is tempting to think that central bankers will be quick to repeat that feat, slashing rates once again as growth falters. Financial markets, let's face it, are enamored with such policy insurance whereby officials instantly cure any economic ills. Consequently, investors are already pricing in hefty cuts.

But there are three good reasons for central banks not to budge this time around and let adjustment take its more natural course. The first is inflation. Price pressures continue to be elevated in much of Asia. Sure, in China, inflation has started to roll over after having peaked this summer. But an easing of headline inflation, even if cosmetically appealing, does not necessarily signal that the battle against rising prices has been won for good.

The issue lies with the underlying rate of inflation that Asia is currently experiencing. Core prices, which strip out volatile items such as food and energy, are rising too fast for comfort. What's more, there is growing evidence that inflation expectations have ratcheted up, which implies that price pressures will linger for quite some time and that central banks must show greater determination in squeezing inflation back into its bottle. Swift loosening of monetary policy may put at risk some hard-earned credibility.

The second reason for resisting temptation and leaving rates on hold is financial stability. It has now become clear that central banks have a prominent role to play in guarding the viability of banks and other such institutions. In fact, the idea that monetary policy can exclusively focus on inflation has been buried for good under the ashes of the global financial crisis.

But even from this perspective, rate cuts would still not be justified. For one, local liquidity is ample and banks are well-capitalized. China's financial system, too, does not face any systemic risk, even as global financial tensions rise further and the economy stumbles into an unlikely recession. Rate cuts, in short, will not be required to guarantee financial stability.

Indeed, rate cuts could raise, rather than lower, the risk of regional financial stability. One by-product of the recent cycle has been extraordinary credit growth. For emerging Asia as a whole, the credit to GDP ratio, a critical indicator of vulnerability, now stands at the same level it did in mid-1997, a date that veteran investors in the region would rather strike from their memory. The risk now is that renewed monetary easing would, at least when things begin to calm down again, fuel another bout of soaring leverage, ultimately pushing up the credit to GDP ratio further.

This brings us to the third reason. Economic and financial weakness in the West may ultimately bring about further monetary easing by the world's major central banks. Already, Swiss officials have committed themselves to printing more money, though admittedly for the unique reason: to prevent the local currency from strengthening further.

In Europe as well as the US, weaker growth only raises the chance of another monetary stimulus, with the US Federal Reserve having already taken a step in its latest "twist". Western liquidity, as before, will ultimately sweep into Asia. There is no need, then, for Asian central banks to accentuate this cycle with local easing of their own.

In China, too, vast amounts of global liquidity could eventually raise leverage and asset prices. Let us be clear - the financial system is sound and not at risk of any imminent stress. Still, it would be a mistake to cut rates now, or, as some have suggested, to reduce reserves requirement ratios aggressively. The economy doesn't need it at this moment and the harmful consequences of over-easing are all too obvious over the long-term. Markets may be calling already for cuts, but it's never wise to give them everything they are clamoring for.

The author is co-head of Asian Economics, HSBC.

(China Daily 10/18/2011 page9)