Monetary easing

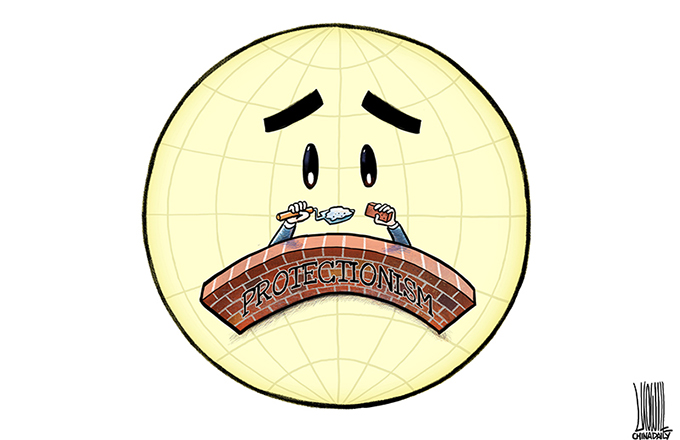

Despite the ostensible firmness in the vow by the G20 that the member countries will refrain from competitive devaluation, the world may have to endure a currency flood as the developed countries resort to currency printing to float their economies.

The G20 finance ministers and central bankers released a carefully worded draft communique at the end of their summit in Moscow on Saturday that upheld market-based exchange rate policies while avoiding criticizing Japan for its recent currency-depreciating policies.

While pushing forward coordination to combat the global economic slowdown, International Monetary Fund chief Christine Lagarde said during the summit that talk of a currency war is "overblown".

Following the US' quantitative easing steps last year, Japan started to pursue an "open-ended" policy of monetary easing this year, which has already driven the yen down 20 percent. The market is now waiting to see whether the euro will follow suit.

While they bring risks to the world economy, especially to developing and emerging market economies, which are prone to the influx of capital, such easing steps are not surprising given the failure of the developed countries to promptly drive their economies.

More than four years on since the eruption of the global financial crisis, the economic recovery of developed countries has been very fragile and unemployment remains high in many of them.

A core reason behind the current economic woes is that they resorted to monetary easing with a view to quickly pulling their economies out of recession. The aftermath of such easing, however, is slow and frequently interrupted recovery because the fundamentals are yet to be improved.

Now the risk is re-emerging that some developed economies want to keep playing the same card. While it is uncertain if their economies can actually gather steam, their monetary easing is set to bring shocks to the developing and emerging market economies, because capital tends to flow to those with better growth prospects.

What is dangerous is that the developing and emerging market economies are weak in coping with massive capital flows that could make their financial market highly volatile.

It is high time the developing and emerging market economies coordinated to figure out solutions and lessen the potential shocks brought by changing external monetary conditions.

At the same time, the self-centered developed economies must be aware that they, too, will suffer once the emerging economies stumble.

(China Daily 02/18/2013 page8)